*Updated February 4, 2021

There has been a significant boom in the number of online stock trading and investing platforms over recent years, making it easier for investors with smaller net worth, like college students, to start trading without having to put down a lot of money.

Two of the most popular mobile stock trading platforms are Webull and Robinhood, which both are extremely easy to sign up for and allow users to invest and make trades commission-free. This article breaks down the two platforms, lists the general pros and cons of each, and will help you decide which is right for you.

Webull vs. Robinhood – Table of Contents

Webull Overview

Founded in 2017, Webull is a trading platform that makes it easy for users to invest in stocks, options, ETFs, and cryptocurrency commission-free. As an added perk, there is no account minimum. So, you can use Webull whether you have $100 or $900,000.

Webull is known for the in-depth information it provides to help users make informed decisions about their investments. In a slick and digestible way, Webull provides users with access to analysis tools and advanced charts to help them stay on top of companies and trends.

General Webull pros

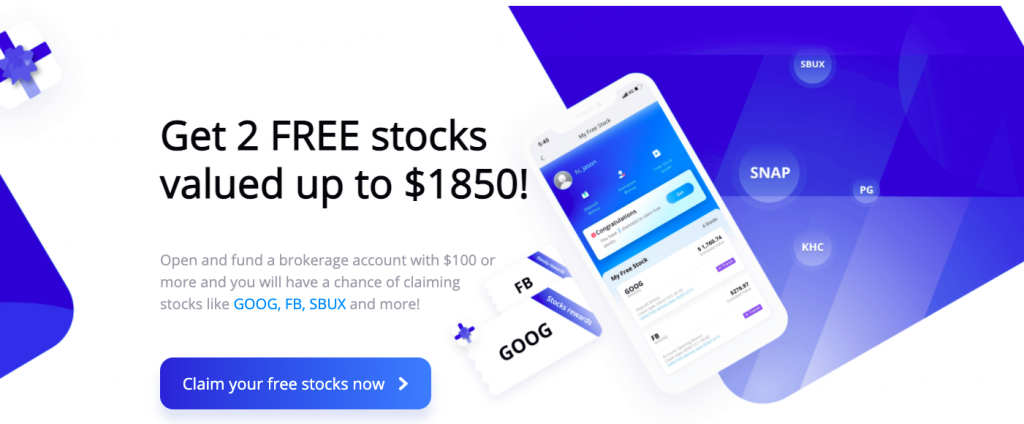

- Sign-up bonus: Everyone loves free money. You’re unlikely to find a sign-on bonus better than Webull’s. Every newcomer automatically receives one free stock. After depositing $100 into your account, you get an additional free stock. Together, the two free stocks, which are chosen at random, can be worth up to $1,850.

Credit: Webull

- No commissions: Webull does not charge commissions for stocks, options, ETFs, or cryptocurrency investing, which is particularly beneficial for those who may not have much cash to work with.

- No account minimum: Webull does not have an account minimum, which is a great feature for those who are new to investing. It doesn’t matter how much money you have in your account as long as you have enough to buy the stock(s) you’re interested in.

- Advanced research tools: Webull is known for the amount of data it offers its users. It offers a wide range of real-time data to help its users make informed decisions. While this data can be very useful for moderate to experienced investors, it can be a bit overwhelming for those who are new to the game.

- Paper trading: Webull offers simulated investing, called paper trading, to help new users get used to trading. Each new user is offered $100,000 in virtual money, which they can use to make mock investments.

- IPO investing: Webull offers initial public offer (IPO) investing. When a company goes public, Webull users have the option to invest in that company immediately. It is worth noting, though, that the number of IPOs available is limited.

- Retirement accounts: Webull offers a few types of individual retirement accounts (IRAs) including traditional, Roth, and rollover, that let you invest and deposit retirement funds.

- Customer service: Webull is also known for its stellar customer service. The company makes itself available to customers around the clock by providing 24/7 access to customer service reps who can help guide users through platforms and answer any questions that they may have.

General Webull cons

- Lots of information: While they try to keep the app and desktop website clean and easy to navigate, the sheer amount of information on Webull can be intimidating to new investors.

- No access to fractional shares: Webull users cannot buy fractional shares of companies. Shares of some companies, like Amazon, cost thousands of dollars each. Fractional shares make it possible for those who don’t have a lot of money to invest in companies with expensive shares.

- Best for very active traders: Webull is best for active traders. For some new investors, having to research and make their own decisions can be too overwhelming.

- No savings account: Webull does not offer a savings account program.

Robinhood Overview

Founded in 2013 with the motto “investing for everyone,” Robinhood markets itself to young people who are new to investing by offering a straightforward trading platform that makes investing easy.

With Robinhood, investors can make unlimited commission-free trades in stocks, ETFs, options, and cryptocurrency. To make things even more convenient for new investors, Robinhood has a $0 account minimum and now offers fractional trading.

General Robinhood pros

- Sign-up bonus: Although it pales in comparison to Webull’s, Robinhood also offers an award program. Robinhood gives all newcomers a free stock that is chosen randomly from its inventory, which can be worth up to $200.

Credit: Robinhood

- Usability: Designed for first-time investors, the Robinhood desktop and mobile platforms are extremely easy to use. Once you have an account, investing and keeping track of your investments is intuitive.

- No commissions: Robinhood does not charge commissions for stock, options, ETFs, or cryptocurrency investing. While this used to set Robinhood apart from the competition, the company is no longer the only free trading platform available. Webull, for example, also does not charge commissions.

- No account minimum: Robinhood doesn’t have an account minimum, which is a great feature for young people who are new to investing. Users only need to have enough money in their account to buy the stock(s) they’re interested in.

- Fractional shares: Fractional shares are yet another feature that Robinhood offers that benefits young people who may not have all that much money to invest. Instead of buying an entire share, users can buy fractional shares that cost as little as $1.

- Recurring investments: Recurring investments is a great feature for those who want to take a hands-off approach to investing. With recurring investments, you can choose an amount and frequency at which you want to invest and Robinhood automatically purchases shares for you.

- Savings program with high interest: Robinhood users can earn high interest on their uninvested cash. Uninvested cash is the money that you have sitting in your account that you plan to invest but have not spent yet.

When you opt to participate in Robinhood’s Cash Management program, your money will be swept to program banks and earn 0.30% interest. For comparison, a Chase savings account has an interest rate of 0.01%.

- Lists: Robinhood allows you to create custom lists of stocks, ETFs, or cryptocurrencies that you’d like to follow. You can also set up alerts so that you know when there is a significant price change or any other news surrounding any of your investments.

- Investing 101: Robinhood provides a lot of information to help new investors learn the basics. On its website and in the app, users can learn the answer to all sorts of elementary questions, including “What is an investment?” and “What is the stock market?”

General Robinhood cons

- Lack of information: Compared to Webull, Robinhood’s basic package lacks research tools and information, which can be dissatisfying for advanced investors. But, users can upgrade to Robinhood Gold for $5 dollars a month to receive access to multiple premium features, including research from Morningstar, Nasdaq, and Nasdaq TotalView.

- No paper trading: Robinhood does not offer users a trial run using simulated money, so users have to jump straight into real-world investing.

- No retirement accounts: Robinhood does not offer any retirement program data. This is just another piece of evidence that suggests Robinhood is targeting the younger investor.

- No short selling: Robinhood does not offer short selling, so users can’t bet on the decline of a stock. Although short selling can be rewarding, it can be very risky, particularly for inexperienced investors.

Webull vs Robinhood: Level of investing experience

Overall, inexperienced investors will likely be more comfortable with the simplicity and beginner-friendly features of Robinhood, while those who’ve been investing for a while may prefer the detailed information and advanced features provided on Webull.

UI Simplicity with Robinhood

There are two major factors that set Robinhood slightly above Webull in terms of being a better option for beginners. The first is usability. As mentioned above, the simplicity of Robinhood’s user interface is unmatched by other investing apps. The second is fractional shares. For newcomers, buying fractional shares is a less intimidating and less risky way to enter the world of investing.

Trade simulation with Webull

That said, Webull does offer simulated investing, also known as paper trading, to help new users become more comfortable with investing. This feature is undoubtedly valuable for new investors. For that reason, it may be worth your time to download both investment apps, collect your free stocks, navigate through the apps, and decide which is right for you.

Webull vs Robinhood: Starting money

The best part about these platforms is that they both have $0 account minimums and don’t charge any commission fees, making investing possible for nearly everyone. As long as you have enough money to buy the stock you like, you can profit from either of these platforms.

However, for both of these investing platforms, the more money you have in your account, the more options you have. For example, both Webull and Robinhood require that investors have at least $25,000 in their accounts to make more than three-day trades in a five-day trading period. And investors on both platforms need at least $2,000 in their accounts to trade on margin, which is borrowing money from a broker to purchase a stock.

Conclusion

Robinhood, with its intuitive interface and beginner-focused features, is a great option for those who are just stepping into the world of investing. Webull, with its advanced features, is best for informed active traders who want the tools to take investing to the next level.

Note: Check here for our Robinhood vs E-Trade article.