*Updated April 4, 2019

More and more high school seniors (and even juniors) along with their parents are worried about the rising cost of higher education. Taking out loans has become the norm, and applying for scholarships has become a part of the application process. Graduating college debt-free isn’t a realistic goal anymore; graduating with as little debt as possible is.

According to the College Board, in the past 10 academic years (2008-09 to 2018-19), the “average published tuition and fee prices rose by $930 (in 2018 dollars) at public two-year colleges, by $2,670 at public four-year institutions, and by $7,390 at private nonprofit four-year colleges and universities.”

The total U.S. student debt is at all-time high with 44 million students owing $1.5 trillion.

Given these numbers, it’s not a surprise that affordability is the fastest growing factor in influencing a student’s choice of college.

For students and parents who want to plan ahead and see how their choice of college and major might impact their ability to pay off student loans, NitroScore is the perfect (and FREE) tool.

Using advanced analytics and real-world, government-supplied data, NitroScore helps you answer the question: How much can I afford to borrow and not be saddled by student debt?

Nitro is like that much-needed friend who not only has the best of intentions, but actually cares enough to give you the reality check that you need.

NitroScore helps you compare the value of specific colleges and majors, so you can make an informed decision about your future.

With NitroScore, you can answer questions like:

- Should I attend a state school or a private college? What is the better investment in the long term?

- Are the expensive private schools, even ivy leagues, really worth it?

- Which majors offer the best projected earnings potential and the best bet to pay off college loans quickly?

- Which majors have the worst earnings potential and offer the least likely path to living a comfortable life?

To make a fully informed and financially sound decision, simply follow these 4 steps on NitroScore:

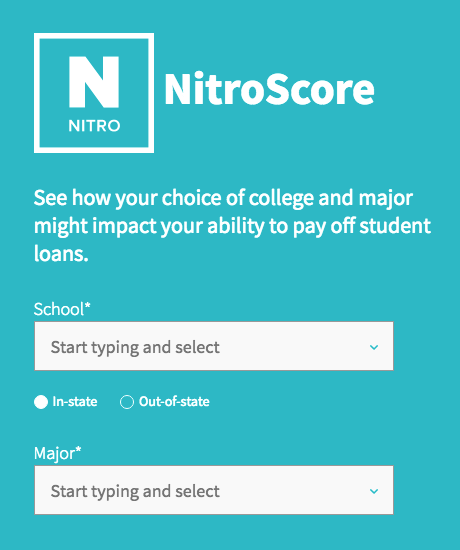

Step 1 – Enter your school and major

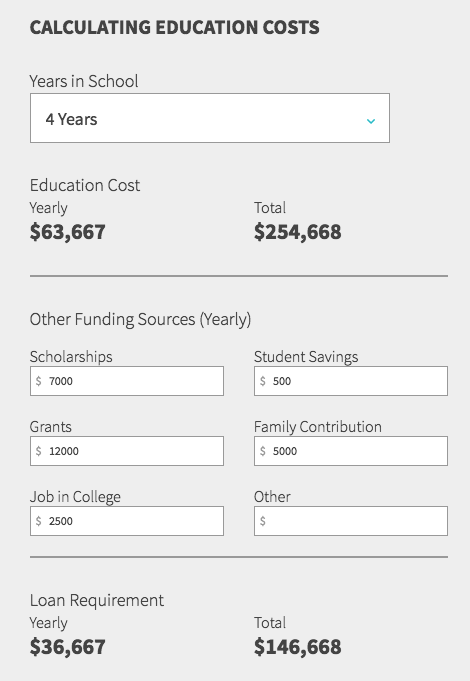

Step 2 – Enter any funding you have, like scholarships, grants, family contribution, savings, etc.

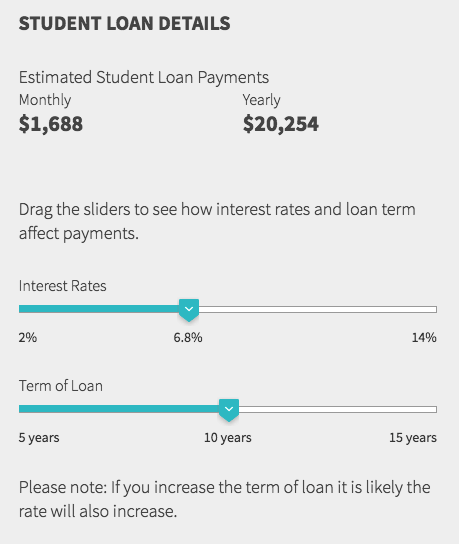

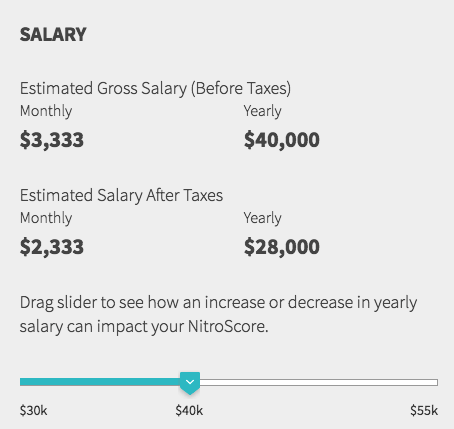

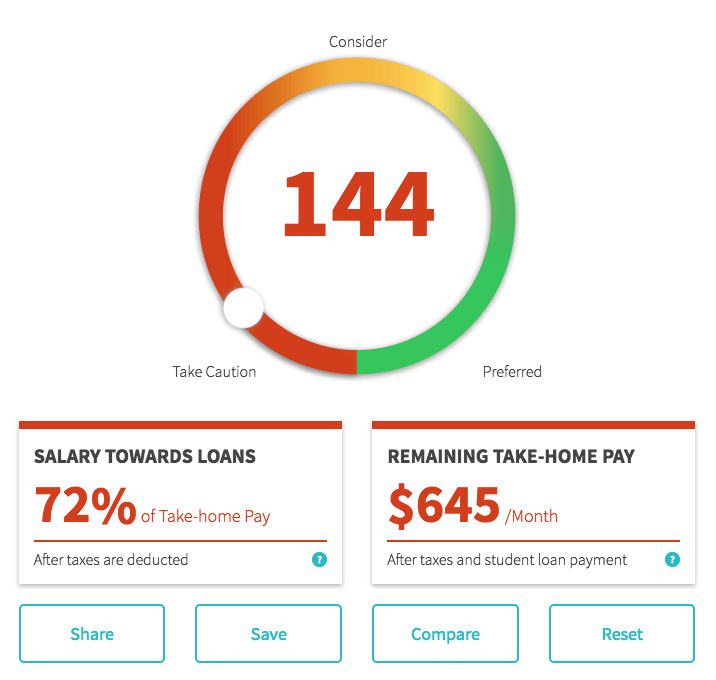

Step 3 – Adjust your student loan details and salary estimates to see how much you would have to pay off in loans (monthly and yearly) vs. how much you would take home.

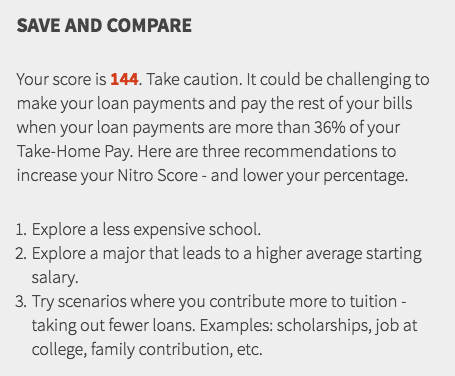

Step 4 – Save your NitroScore and compare different scenarios for different schools, majors, and other adjustments, to see which combination has the highest NitroScore. *The higher the NitroScore, the better the choice and chance of you paying off your loans.

[button-green url=”https://score.nitrocollege.com/” target=”_blank” position=”center”]Try NOW[/button-green]