If you’ve taken out federal student loans to finance your education (like I did) and you have EdFinancial Services as your loan servicer, you need to take stock of where you stand with respect to your loans and learn about your repayment options. This is critical if you want to put your best “financial” foot forward and be in control of your student loans.

Here’s what you need to know to manage your EdFinancial Services student loans.

1. What is EdFinancial Services?

The U.S. Department of Education is your lender, but federal loans are serviced by nine loan servicing organizations/companies assigned to help the government manage the billing and other services for your loan, including EdFinancial Services.

Although EdFinancial has been in the student loan industry for over 25 years, it has been servicing federal student loans only since 2012. The company has its headquarters in Knoxville, Tennessee. EdFinancial also services FFELP and private loans, but in this article, we address federal DIRECT loans only.

You could have more than one servicer if you have multiple loans. To confirm, check with the National Student Loan Data System.

2. What do you need to do to manage your EdFinancial loans?

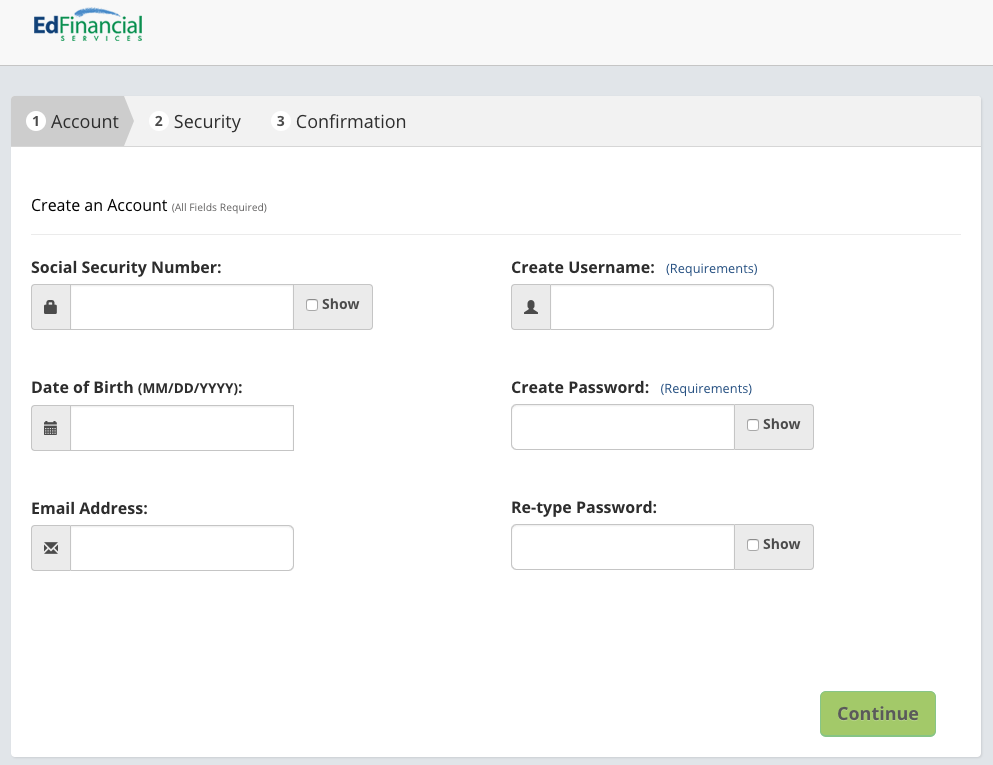

If you haven’t already set up an online account with EdFinancial, you should create one immediately.

The online process is easy. Go to the “Create a New Account” page and fill in the required information, including your social security number, birthdate, username and password.

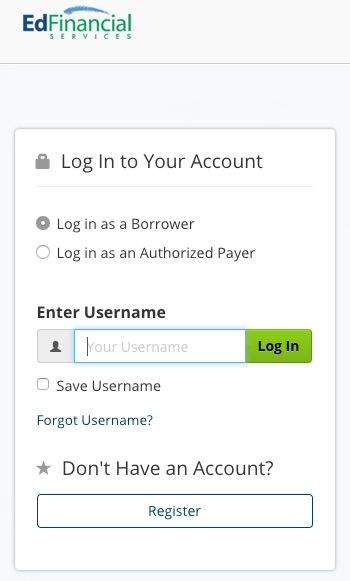

Once you’ve set up an account, or if you already have an online account, you can log in to access your account.

EdFinancial’s online portal makes it easy for you to review and manage your account. You can:

- Get loan details, including loan balances and the interest rates being charged;

- Make your payments; and

- Update your personal information.

You can find other helpful tips and resources at the Help Center and download forms you need.

3. What if you have a question and need to contact EdFinancial?

You can phone, email and mail/fax EdFinancial.

- Phone — Your social security number or EdFinancial account number is required.

| Toll-Free – for general inquiries and

phone payments only |

855-337-6884 |

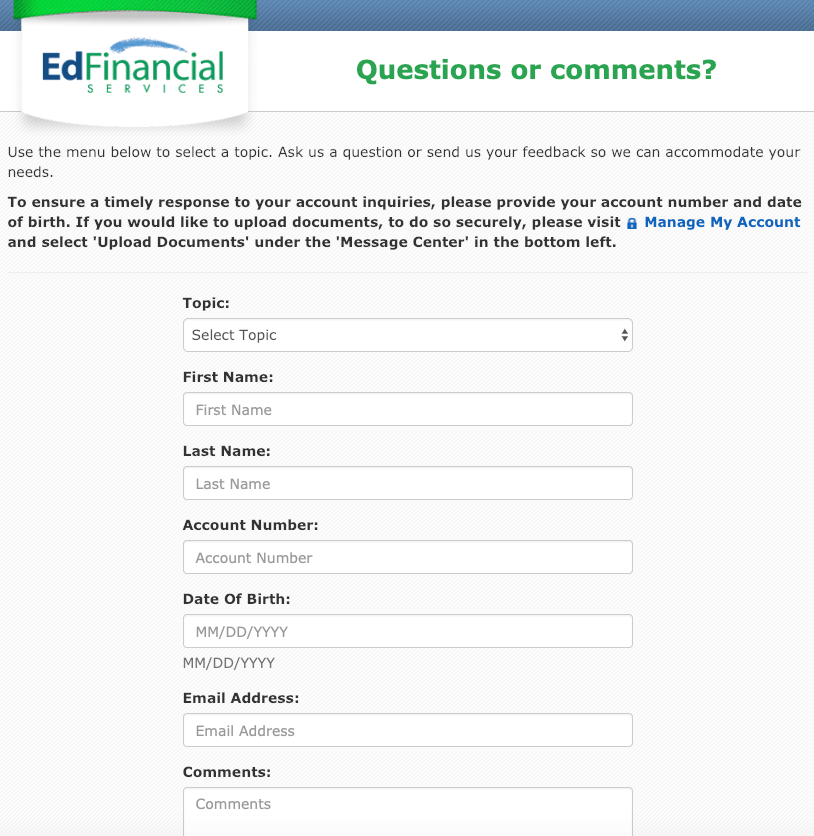

Email: Use this form to send an email from EdFinancial’s website.

| Payments only | US Department of Education

PO Box 105193 Atlanta, GA 30348-5193 |

| Letters or documents only | EdFinancial Services P.O. Box 36008 Knoxville, TN 37930-6008 |

- Fax (letters or documents only)

| Toll-Free | 800-887-6130 |

| International | 865-692-6348 |

EdFinancial’s Hours of Operation are:

Mon-Thurs: 8:00 AM to 8:30 PM (ET)

Fri: 8:00 AM to 6:00 PM (ET)

But, you can get payment and automated account information 24/7 by calling 1-866-709-0202.

4. What if you have a problem with EdFinancial?

EdFinancial is not without its problems. In January 2020, the Better Business Bureau shows 32 complaints were filed in the past three years, of which 23 had to do with EdFinancial’s billing and collection practices and nine involved problems with products and services.

So, what should you do if you have questions, concerns or issues with your EdFinancial loans?

Contact EdFinancial right away by phone, email and/or mail/fax (see contact list above).

If EdFinancial cannot or does not resolve your problem, or you disagree with EdFinancial, contact the Federal Student Aid Ombudsman Group. You can also file a complaint with Federal Student Aid and/or the Consumer Financial Protection Bureau.

At all times, it will help if you have identified the nature of your loan problem and have documented all the details, including notes of phone conversations, identity of EdFinancial representatives etc.

5. What is the best way to deal effectively with EdFinancial?

The Department of Education has provided several tips on this, including keeping careful notes of conversations, following up in writing after a conversation, keeping copies of correspondence and replies sent by mail, sending letters by certified mail, and more.

6. What are the payment methods?

You can make your EdFinancial payments in many ways, including KwikPay® and by mail. Before you proceed, know that you can choose a payment date that works best for you.

- If you choose KwikPay®, your loan payments will be automatically deducted from your checking or savings account on your due date each month, or on the next business day if your due date falls on a weekend or holiday. To avoid missing a payment, be sure to send a payment using other methods until EdFinancial confirms you are set up for KwikPay.

- Logging in and paying online allows you to make a single payment or schedule it 30 days in advance (be sure to schedule your payment for a business day, even if your payment falls on a weekend). You can also authorize another person to make payments for you by adding “Authorized Payers” after you log in.

- You can also pay by phone 24/7, using the automated phone system by calling 1-866-709-0202. You will need your 10-digit account number or EdFinancial account number to use the automated phone system. You can also call 855-337-6884 during regular business hours and make your payment with a representative, but there may be a convenience fee.

- If you prefer to send your payment by mail, make your check or money order payable to “US Department of Education” and send to the payment address above. Be sure to have your name, account number and correct payment amount on the check or money order. Your payment should be mailed at least 5-7 business days before your due date to ensure receipt by due date.

- For payment by your financial institution’s online bill pay service or other bill pay service provider, be sure that they have the correct account number and payment address (see payment by mail above). The downside of using this method is that you will still need to contact EdFinancial directly if you have additional instructions.

When EdFinancial receives a payment, it is applied first to outstanding interest and late fees, if any, and then to the principal balance.

7. Should you make extra payments?

If you have extra money, the answer is definitely YES. This will help you pay off your loans faster and save you money.

No matter which payment method you choose, you have the option to make extra payments on individual loans.

For recurring extra payments, the easiest way is to use KwikPay®. Just specify the additional amount you want automatically debited in the “Additional Amount” field in “Manage My Account” after logging in to your account. The “Total Monthly KwikPay Amount” will then include the “Additional Amount.” This method does not allow you to specify how the additional amount will be applied.

You can make a single extra payment manually online by logging in to your account. Unlike KwikPay®, you can even target your payments toward specific loans at the time of payment.

If you prefer, you can also make single extra payments by phone or mail, using the payment information above.

You can also contact EdFinancial to request a shorter repayment term, but this means your monthly payments will be fixed at a higher rate. Be sure that you can afford to pay the higher monthly payments before you make a decision.

8. How do you ensure that EdFinancial correctly allocates your extra payment?

Extra payments are automatically applied towards the principal of the loan (proportionately to all loans, if you have multiple EdFinancial loans).

If you want EdFinancial to target specific loans, the easiest way to accomplish that is to make your extra payments manually online. Otherwise, you should contact EdFinancial with specific instructions.

For maximum benefit, you should target the extra payments to unsubsidized loans, loans with high balances, or loans with higher interest rates — whichever will save you more money in the long run.

9. What are your repayment options?

Although you make your payments to EdFinancial, it is the Department of Education that provides the repayment options. Your options may vary by the type of loan you have.

Here are the standard repayment options:

- Standard Repayment Plan: This plan saves you the most money because it allows you to pay off your loan most quickly — within 10 years if you have unconsolidated loans, and within 10-30 years if you have consolidated loans. However, since the fixed monthly payments are higher, this is not a viable option for borrowers seeking PSLF. By the way, this will be your default option if you don’t choose a repayment plan.

- Graduated Repayment Plan: With this plan, you will start with low monthly payments that will increase every two years. You pay off your loan within 10 years if you have unconsolidated loans, and within 10-30 years if you have consolidated loans. This plan may be a good fit for borrowers whose current income is low but expect an increase over time. It’s generally not an option for those seeking PSLF.

- Extended Fixed Repayment Plan: If you need to lower your monthly payments, this plan gives you the option to extend your payment period up to 25 years. You will have a fixed monthly payment. To qualify, your outstanding loan amounts must be more than $30,000. This plan is not an option for those seeking PSLF.

- Extended Graduated Repayment Plan: This plan also gives you the option to extend your payment period up to 25 years, but your lower monthly payments increase over time. To qualify, your outstanding loan amounts must be more than $30,000. This plan is not an option for those seeking PSLF.

Additionally, there are four income-driven repayment plans (IDR), in which payments are based on a percentage of the borrower’s discretionary income. The percentage varies based on the plan. Payments for all four IDR plans are recalculated each year and are based on your updated income and family size, so you must update your income and family size each year (even if there are no changes). IDR plans are good options for those seeking PSLF, which forgives the remaining balance on Direct Loans after borrowers have made 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying employer.

- Revised Pay As You Earn Repayment Plan (REPAYE) Income Sensitive Repayment: Your monthly payments are generally 10% of your discretionary income. If you haven’t paid back your undergraduate loans in full after 20 years, or your graduate or professional study loans after 25 years, the outstanding balance will be forgiven, but you may have to pay taxes on the amount forgiven.

- Pay As You Earn Repayment Plan (PAYE): Your monthly payments will be 10% of discretionary income, but will not exceed what you would have paid under the 10-year Standard Repayment Plan. If you haven’t paid back your loan in full after 20 years, the outstanding balance will be forgiven, but you may have to pay taxes on the amount forgiven.

- Income-Based Repayment (IBR): The percentage depends on whether you’re considered a new borrower on or after July 1, 2014, or not. If you are a “new borrower,” your monthly payments are generally 10% of your discretionary income. If you’re not, your monthly payments will be 15% of your discretionary income. If you haven’t paid back your loan in full after 20 or 25 years (depending on when you received the loan), the outstanding balance will be forgiven, but you may have to pay taxes on the amount forgiven.

- Income-Contingent Repayment (ICR): Your monthly payments will be the lower of 20% of your discretionary income or the amount you would pay under a fixed repayment plan over 12 years. If you haven’t paid back your loan in full after 25 years, the outstanding balance will be forgiven, but you may have to pay taxes on the amount forgiven.

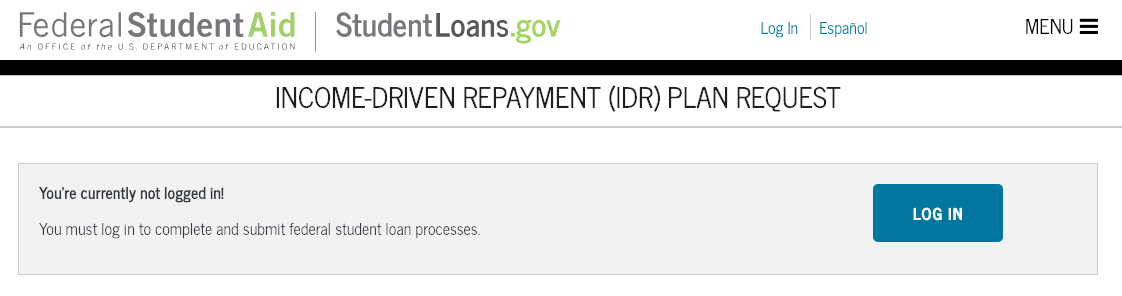

If any of the IDR plans will make your student loan debt more manageable, you can apply to the Department of Education at StudentLoans.gov to enroll and to update your income and family size, once annually.

Before you choose a repayment plan, though, you should use EdFinancial’s Loan Repayment Plan Evaluator.

10. What if you’re having trouble paying back your loans?

Get in touch with EdFinancial right away if you’re struggling to make your monthly payments. You don’t want a situation where your loan becomes delinquent or in default, because it will affect your credit score.

An account is “delinquent” the day after a first missed payment, and is deemed “in default” when it is 270 days delinquent. So, if you miss one or two payments, your loan is delinquent. But if you miss several payments, your loan will be at risk of default.

If you have money for your monthly payments but you forget, simply changing your method of payment to KwikPay® will ensure timely payments.

If you can’t afford your monthly payments, however, you need to check into lowering your monthly payments. Here are a few options:

- You can apply for IDR plans, which are based on your income, family size and state of residence, at StudentLoans.gov. To determine which IDR plan is best for you, you should have your loan details — current loan balances, loan program and interest rate of each loan, and how many months you have been repaying your loan — available. Reminder — more details are in the “repayment options” section.

- If you have multiple federal loans, you can apply to consolidate some or all of the loans into a single loan called a Federal Direct Consolidation Loan through StudentLoans.gov. In your application, be sure to note if you are interested in PSLF. The consolidated loan will bear a fixed interest rate based on the average of the interest rates on the loans being consolidated. There is NO application fee. Once consolidated, you will have a single monthly payment to make for all the loans you consolidated. Check out the potential advantages and disadvantages before you apply for consolidation.

- Another option is to refinance your loans through private lenders. Refinancing, like consolidation, allows you to roll multiple loans into one loan. Your interest rate is typically determined by your credit score. The caveat: borrowers who refinance federal student loans lose benefits provided by federal loans, including access to IDR plans that may qualify them for loan forgiveness after 10, 20 or 25 years of payments.

If you’re in a situation where you need to postpone your monthly payments temporarily, you have two options: deferment or forbearance. Both programs could have a major impact on the amount you have to pay back. Neither program is ideal, particularly if you’re working towards loan forgiveness, as it may delay the time it takes to qualify for loan forgiveness. A better option may be to apply for IDR plans instead.

The bottom line

To ensure compliance with your loan obligations and for maximum savings, you should learn the terms of each of your federal loans. And don’t hesitate to contact EdFinancial if you have any questions, issues or concerns.