The FAFSA (Free Application for Federal Student Aid) is a college student’s gateway to financial aid, be it grants, work-study programs available at your school, federal student loans, or state and school financial aid awards.

Current and prospective colleges need a completed FAFSA form to determine a student’s eligibility for various forms of financial aid. It is, therefore, critical that you (and your parents) get it right when completing the FAFSA form.

The new FAFSA form, which was launched on December 31, 2023, is shorter and easier to complete. Depending on the information you are required to fill out, it could take as little as 10 minutes but not more than an hour to complete. The trick to a seamless and stressless FAFSA application is to be organized, follow directions and pay attention to the details.

Here is what you need to know to help you complete your FAFSA form correctly and on time.

- 1. Start the process early

- 2. Stay on top of deadlines

- 3. Determine if you’re a dependent student

- 4. Collect the documents you need

- 5. Figure out who counts as your parents

- 6. Create your FSA ID

- 7. Start your FAFSA form

- 8. Fill out your personal information

- 9. Fill out your financial information

- 10. Choose your schools

- 11. Fill out the parent section – and the parent spouse/partner section – or have them complete it

- 12. Fill out the spouse section, if applicable, or have your spouse complete it

- 13. Sign and submit your FAFSA form

- 14. Check your FAFSA status

1. Start the process early

October 1 is typically the open date — the first date that the FAFSA form is available for use — for the next school year. However, the FAFSA form for the 2025-26 year will open on December 1, 2024.

In any case, the sooner you apply, the better it is for you. Applying early will give you room to maneuver if you should run into problems with your application and increase your chances of getting state and college aid if you’re eligible.

2. Stay on top of deadlines

It’s crucial that you stay on top of deadlines. If you miss a deadline, you won’t get financial aid for that school year.

So keep track of not just the federal deadline but also your state and individual college deadlines. This is fairly simple for current college students who are renewing their FAFSA – they just have their current college, or the college they are transferring to, contend with. However, it can be tricky for high school seniors applying to several colleges, in which case we suggest using a spreadsheet to keep track of the various deadlines – list the due dates and any additional forms you are required to submit.

A. When is the FAFSA due?

June 30 of the school year for which you are applying for financial aid is the federal deadline for online applications. This means that for the 2024-25 school year, your online application must be submitted by midnight Central Time (CT) on June 30, 2025. Note that you will be completing the old FAFSA, which is longer and more complicated than the new form.

If you need to correct any errors or update information submitted on a FAFSA, you must do so by the due date – September 14, 2025 for the 2024-25 FAFSA.

| Federal deadline for 2024-25 school year | June 30, 2025 (midnight CT) |

| 2024-25 Corrections/Updates | September 14, 2025 (midnight CT) |

B. What are the college financial aid deadlines?

Colleges may have their own deadlines, which may be different from the federal deadline. If you’re a freshman or transfer student, contact the financial aid office at all the colleges you would like to attend and find out not just the deadline but also what you need to accomplish by that date. For example, ask if the college is using the date of receipt or the date the FAFSA is processed as its deadline. For returning students, you just need to check with your current college.

C. What are the state financial aid deadlines?

The deadline for state financial aid may be the same as the federal deadline, or it may vary by state and the type of aid within each state. Check here for the deadline and additional forms, if any, for your state.

To ensure that you receive state financial aid, submit your FAFSA form as close to the open date as possible. Delaying your application increases the risk of your state running out of funds by the time your FAFSA form is received or processed.

3. Determine if you’re a dependent student

Your status as a “dependent” or “independent” student is important because FAFSA requires different information based on your status. If you’re a dependent, you will be asked to submit your parents’ information in addition to yours. If you’re an independent student, you only have to submit your own information, unless you’re married, in which case you have to submit your spouse’s information as well.

So, how do you determine if you’re a dependent student?

FAFSA has 12 questions that will help you determine your dependency status for the purpose of applying for financial aid. While some questions are straightforward like the date of your birth, others are more complicated and require more thought, but you should be able to answer the questions if you follow FAFSA’s directions and clarifications.

You are a dependent student if your answer is “NO” to ALL 12 questions. This is true, even if you’re not living with your parents, they don’t claim you as a dependent on their tax forms, or you’re paying your own expenses, including educational expenses.

You are an independent student if your answer is “YES” to ANY one of the 12 questions, in which case you may not be required to provide parent information on your FAFSA form.

If you are unclear about any of these questions (or have any questions during the application process), don’t hesitate to ask your college’s financial aid office.

4. Collect the documents you need

Start collecting the documents you need to support your application a day or two before you (and your parents) actually sit down to fill out the FAFSA form. Organize them by category and have them handy.

What are the documents you need for FAFSA?

The documents or information you actually need to provide as part of your FAFSA application will depend on your status as a “dependent” or an “independent” student, U.S. citizenship, and the tax forms you (and your contributors – i.e., your parent, your parent’s spouse or partner, and/or your spouse) used.

If you are a dependent student, your parent(s), or your parent and his/her spouse or partner, will need to furnish their personal and financial information.

If you are married or remarried, your spouse will need to furnish his/her personal and financial information.

Generally, though, for the 2024-25 FAFSA, you and your contributor(s), if any, will need to provide the following information:

- Social Security number(s), or Individual Taxpayer Identification Number (ITIN)

- Tax returns for 2022 — IRS Form 1040 or 1040-NR

- Records of child support received

- Current balances of cash, savings, and checking accounts

- Net worth of investments, businesses, and farm (excluding the home you live in and retirement accounts)

5. Figure out who counts as your parents

I’m not kidding. You think you know who your parents are, but the picture is not so clear for purposes of financial aid.

Let’s start with the definition of a parent.

A “parent” must be a legal (biological or adoptive) parent or stepparent, or a person deemed by the state to be a legal parent, such as the parent listed on your birth certificate. (It doesn’t matter if your parents are of the same gender.)

So, who are your parents for FAFSA purposes?

Here’s a general guideline:

- If your parents are married to each other, they both count.

- If your parents are not married to each other but they live together, they both count.

- If your parent is widowed or was never married, that is the parent who counts.

The situation is more complicated when your parents are divorced or separated (either legally separated or because they choose to live separate lives even though they are married).

If they are divorced or separated and don’t live together, the parent who counts is the parent with whom you lived more in the past 12 months. If that parent is remarried, your stepparent counts as well. (A stepparent doesn’t count if widowed, and he or she did not legally adopt you.)

But if the time you lived with them is the same, then the parent who counts is the parent who provided more financial support in the past 12 months or the most recent 12 months in which you actually received support from a parent. If that parent is remarried, your stepparent counts as well.

If your parents are divorced and live together, they both count — check off “Unmarried and both parents living together” in your FAFSA form.

If your parents are separated and live together, they both count — check off “Married or remarried” and NOT “Divorced or separated” in your FAFSA form.

The picture gets even more fuzzy if your parents’ marital status has changed since they filed taxes for the year in question. Let’s walk through various scenarios, using the 2024-25 school year for your FAFSA application, which requires 2022 tax information.

The key here is that you’re answering the FAFSA question on marital status “as of today”, i.e., the day you’re filling out the FAFSA form.

Scenario 1 — Your parent (who counts) was NOT married in 2022 and didn’t file taxes as married. However, on the day you’re filling out the FAFSA form, that parent is married. This means that you will need your stepparent’s 2022 income on your FAFSA form.

Scenario 2 — Your parent (who counts) was married in 2022 and filed taxes as married. But the parent is no longer married on the day you’re filling out the FAFSA form. This means that you will need to deduct your parent’s former spouse’s 2022 income from your FAFSA form.

Scenario 3 — Your parent (who counts) was married in 2022 and filed taxes as married. But the parent is divorced and married to another person on the day you’re filling out the FAFSA form. This means that you will need to deduct the former spouse’s 2022 income, but add the new spouse’s 2022 income.

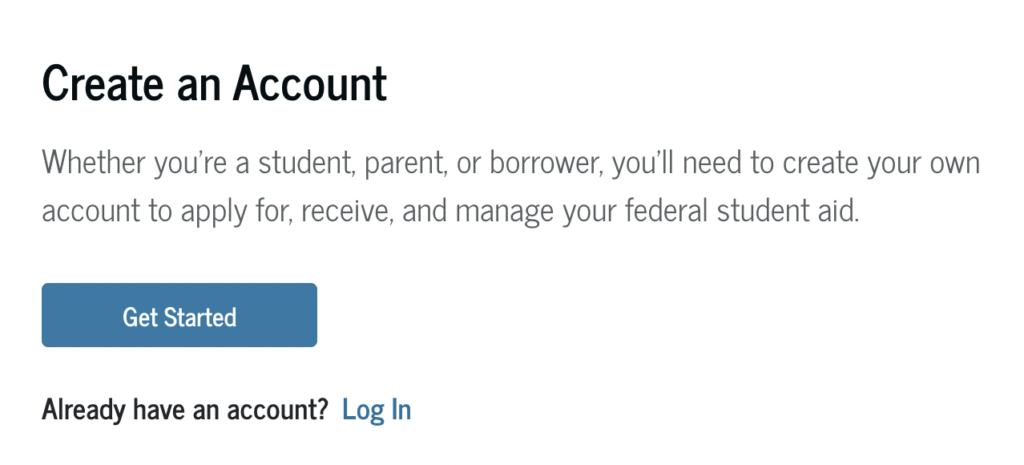

6. Create your FSA ID

Now that you know what and whose information you need to report, it’s time to create your FSA ID — a unique username and password combination. This will only take you a few minutes.

Note: You only have to create your FSA ID once, although you need to update your password every 18 months. Keep your FSA ID somewhere safe, as you will need it to renew your FAFSA in subsequent years.

With your FSA ID, you can sign your FAFSA form electronically, access the myStudentAid app, sign your loan contracts, and access your financial aid information online.

To get started, go to the Create an Account page. Then, click on “Get Started” and follow the instructions.

Step 1 – Enter your full legal name, date of birth, and Social Security number. Be sure to enter them accurately!

Note: Your name, date of birth, and Social Security number must MATCH EXACTLY the information on your Social Security card, so it ties in with your Social Security Administration’s records.

Step 2 — Enter your email address, username and password.

Step 3 — Enter your mailing address, confirm if you wish to register a mobile phone number that you can use to reset password and retrieve username (provide the number if you do), and set your language preference.

Step 4 — Complete the “challenge questions and answers” segment. The information you provide will be used to retrieve your password or username and to unlock your account.

Step 5 — Verify your information. If there are any errors, select “PREVIOUS” and correct the errors. Otherwise, review the terms and conditions and click the box to accept them.

Step 6 — If you elect to register a mobile phone number, you will receive a secure code by text. Enter the code to verify your phone number.

Step 7 — You will receive another secure code by email. Enter the code to verify your email address and click “submit.” You are DONE.

Note: Your email and mobile number can only be associated with your FSA ID.

Your FSA ID will be ready for use once your information is confirmed with the Social Security Administration. Your FSA ID is ONLY for YOU to use. DON’T SHARE it with anyone, even your parents.

If you are a dependent student, one of your parents will need to create his or her own FSA ID in order to sign your FAFSA form electronically. With the new FAFSA, a parent who doesn’t have a Social Security number can create an FSA ID.

If you have siblings in college, your parents can use the same FSA ID, but each of your siblings will need to create his or her own FSA ID.

7. Start your FAFSA form

There are three ways to complete the FAFSA form:

- Complete it online at the official website;

- Fill out the 2024-25 FAFSA PDF form online, print it out and mail it for processing; and

- Call 800-433-3243 for a hard copy of the FAFSA form to be sent to you, complete it and mail it for processing.

The first two options are the most convenient, but your parent(s) — if you’re a dependent student — must have an FSA ID in order to sign your FAFSA form electronically.

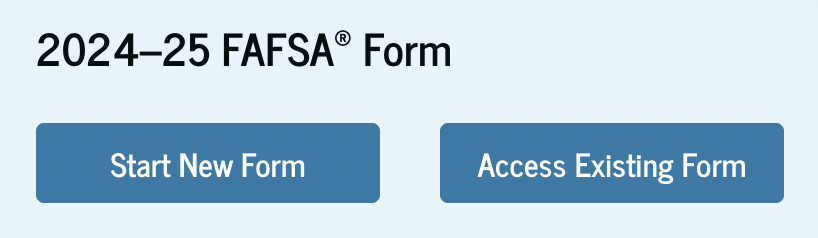

A. Online application

To apply online for the 2024-25 FAFSA, click “Start New Form.” You will need to log in with your username and password.

Because the 2024-25 FAFSA form is new, even students who are renewing their FAFSA for this year will need to “Start New Form.”

You can save your information as you progress by selecting “Save” on any page. To retrieve your saved application, all you have to do is log in with your FSA ID and go to the “My Activity” page.

B. PDF or hard copy application

If you are filling out a PDF or hard copy application, be sure to follow the instructions on how to fill out each field correctly. In terms of mechanics, for example, you should use black ink, fill circles completely, use capital letters, and skip a box between words. And don’t use cents for dollar amounts. For example, if your income is $12,500, enter 12500 — and not 12500.00 — in the appropriate boxes, otherwise the income would be reported as $1,250,000. Commas are already provided to separate groups of thousands, so it shouldn’t be a problem. If you’re in doubt, start filling out the number from the rightmost position.

8. Fill out your personal information

This is an easy section where you provide your basic information — name, date of birth, citizenship status, gender, marital status, and so on.

Note: Since the FAFSA is a student’s application, the words “you” and “your” apply to you (the student), not your parents.

9. Fill out your financial information

If you’ve already gathered the documents in #4 above, use the financial information from the relevant documents.

Don’t worry if the financial situation has changed significantly since you (and your parents) filed taxes. Just answer the FAFSA questions as required, submit the FAFSA form, and then call the financial aid office at your intended/present college to explain your situation.

An easy way to complete the financial section is to select the Internal Revenue Service Data Retrieval Tool (IRS DRT), which will automatically transfer your tax information to your FAFSA form. Check here to find out when your tax return information will likely be available via IRS DRT.

10. Choose your schools

You must specify at least one school on your FAFSA form. Check here to find the Federal School Code.

With the new FAFSA, you can list up to 20 schools. If applying by PDF, you are limited to 10 schools initially, but you can add to your list.

In any case, you can always add or delete a school.

The order in which you list your schools doesn’t matter for federal aid purposes. However, if you’re applying for state aid, bear in mind that some states require you to list your schools in a specific order.

Also, if you’re applying to multiple colleges, you need not worry about the schools knowing which school is on your list. Your school list is kept confidential and cannot be seen by another school on your list.

11. Fill out the parent section – and the parent spouse/partner section – or have them complete it

You and your parent(s) – and their spouse or partner, if applicable – need to complete this part only if you’re a dependent student.

This part should be easy, as you’ve figured out who counts as your parents for FAFSA purposes from #5 above, and you’ve already collected the required documents from #4 above.

If you can’t provide parent information, you can indicate that on your FAFSA form, but call your school’s financial aid office right away and explain your situation.

If you have a special circumstance that prevents you from providing your parents’ information, it will be up to the school’s financial aid office to decide if you can be considered as an independent student. If your parents refuse to provide their information, you will be limited to unsubsidized loans, which require you to pay interest even when you’re in school, in grace period, or in deferment. In both cases, the decision will rest on the school’s financial aid office.

For details on how your special circumstance, or your parents’ refusal to provide information, impacts your FAFSA application, check here.

If your parents are concerned about providing information because they are non-U.S. citizens, let them know that the FAFSA form does not inquire about their citizenship status and that it doesn’t affect your application.

Check here for tips on how to report your parents’ information if they are non-U.S. citizens.

12. Fill out the spouse section, if applicable, or have your spouse complete it

A spouse section is a requirement on the new FAFSA. You or your spouse need to complete this part only if you’re married or remarried.

13. Sign and submit your FAFSA form

Your last step — after double-checking the accuracy of the information you’ve entered on your FAFSA form — is to sign your form.

For quick processing, sign with your FSA ID or use your FSA ID to log in.

Your FAFSA should also be signed by anyone who is required to fill out the form. Your application would be considered incomplete otherwise.

Next, submit your form — online is efficient and quick (just 3–5 days to process). Mail-in applications will take 7–10 days.

For seamless submission, be sure that your browser allows pop-ups from fafsa.ed.gov.

Note: Submit early, so your financial aid is in place by the time you start school. Otherwise, you may have to cover your tuition and other fees until the financial aid is disbursed.

14. Check your FAFSA status

When your 2024-25 FAFSA is processed, you will receive your FAFSA Submission Summary from the office of Federal Student Aid — within a few days of online application or two weeks of mail-in application. Your Submission Summary contains basic information about the FAFSA information you provided, lists your Student Aid Index (SAI), and provides an estimate of the amount of federal student aid that you may be eligible for.

The SAI is an index number ranging from –1500 to 999999, which is calculated using the information that you and your contributors provided on the FAFSA form.

Once your college, career school, or trade school knows your SAI, they will use it to calculate how much and what types of financial aid you’re eligible to receive.

Check your Submission Summary for accuracy and correct your FAFSA information right away if you made a mistake.

Next, you will receive aid offers or award letters from the schools you have been accepted at. You should compare them to see what’s best for you — your goal is to borrow as little as possible, so you are not overburdened with student debt.

Conclusion

It is crucial to fill out the FAFSA if you want to get federal, state or college aid. To maximize aid, be sure that you meet not just the FAFSA deadline, but your state’s and college’s deadlines. Also, remember that you must fill out the FAFSA every year if you want to stay eligible for financial aid, so be sure to keep abreast of any changes in the form and comply with deadlines.

For further insights and resources on the financial aid process and other higher education topics, be sure to check out TUN AI, our AI-powered platform for personalized guidance.