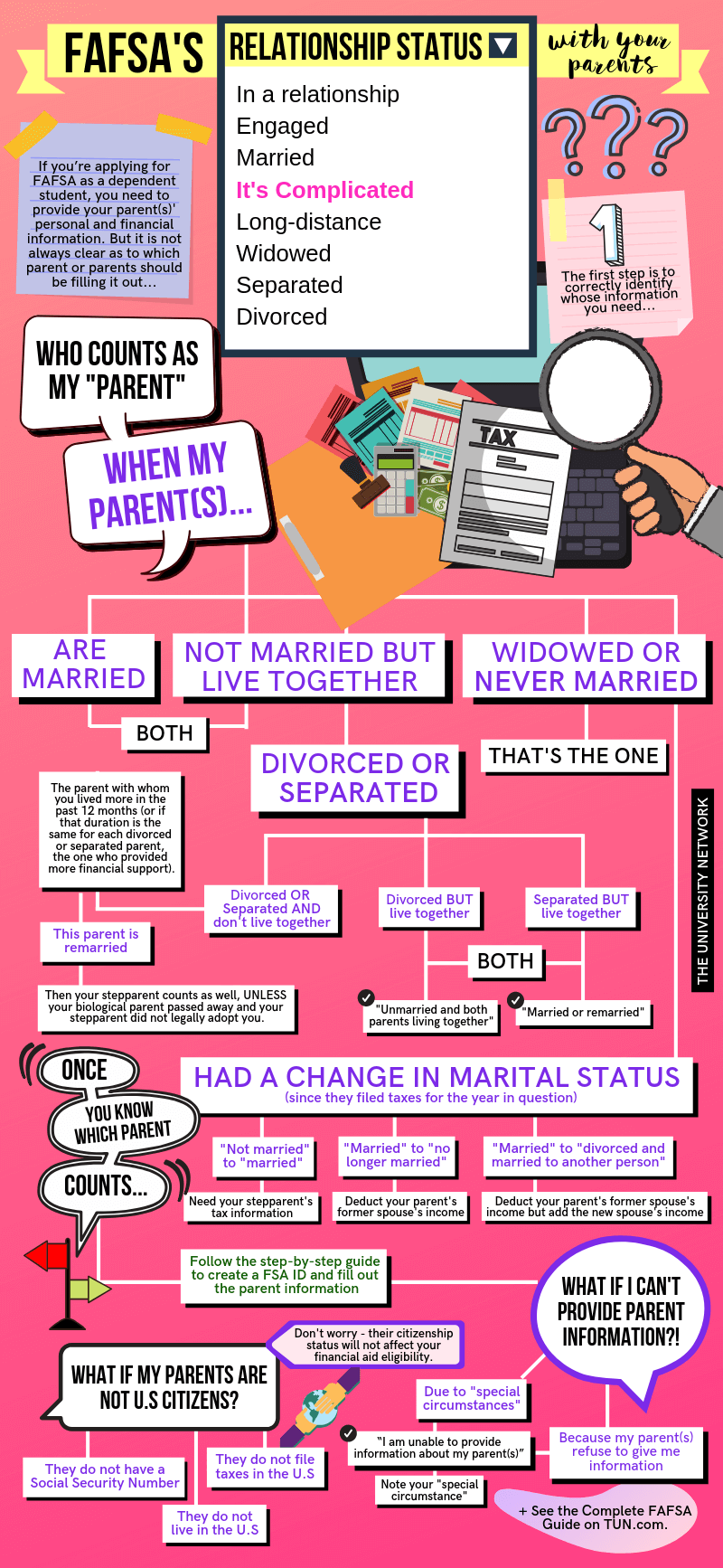

If you’re applying for financial aid to help you pay for college and you are considered a dependent student in the eyes of the FAFSA (Free Application for Federal Student Aid), you are required to provide your parent’s or parents’ personal and financial information. But it is not always clear as to which parent or parents should be filling out your FAFSA form.

If your parents are married, or they are not married to each other but live together, then it’s easy — they need to fill out your FAFSA. Some situations are not so simple, though, and require you to go through a complex analysis to figure out which parent(s) should be filling out your FAFSA form.

But, why is it so important to determine who your parents are for FAFSA purposes?

The financial aid office at current and prospective colleges need a completed FAFSA form to determine a student’s eligibility for various forms of financial aid, which can be in the form of grants, work-study programs, federal student loans, or state and school financial aid awards.

For the 2024-25 school year, the financial aid office will calculate your aid — type of aid and amount — based on the Student Aid Index (SAI) included in your 2024-25 FAFSA Submission Summary. The SAI is an index number ranging from –1500 to 999999, which is calculated using the information that you and your contributors provided on the FAFSA form.

For the 2023-24 school year, the financial aid office will calculate your aid based on the Expected Financial Contribution (EFC) in your 2023-24 Student Aid Report (SAR). Your EFC is an index number that varies from school to school based on their cost of education.

It is in your best interest, therefore, to get it right when you fill out the FAFSA form, and that includes providing the correct parent’s information.

Here is a step-by-step approach to help you identify your parents for FAFSA purposes.

Let’s begin with the definition of a parent.

A “parent” must be a legal (biological or adoptive) parent or stepparent, or a person deemed by the state to be a legal parent, such as the parent listed on your birth certificate. (It doesn’t matter if your parents are of the same gender.)

Note: Grandparents, foster parents, legal guardians, older brothers or sisters, uncles or aunts, and widowed stepparents are NOT your legal parent(s) unless they have legally adopted you.

Now that we know who could be a legal parent, let’s walk through various scenarios to see which one applies to you.

- 1. Who is my parent when my parents are married?

- 2. Who is my parent when my parents just live together?

- 3. Who is my parent if my parent is widowed or never married?

- 4. Who is my parent when my parents are divorced or separated?

- 5. Do I need to include my stepparent’s information for FAFSA?

- 6. Who is my parent when there has been a change in my parents’ marital status?

- 7. How can my parents help me with my FAFSA form?

- 8. What if I cannot provide parent information on my FAFSA form?

- 9. What if my non-U.S. citizen parents are afraid of providing information to FAFSA?

- 10. How do I fill out non-U.S. citizen parent information on the FAFSA form?

- The bottom line

1. Who is my parent when my parents are married?

If your parents are married to each other, they both count. Their gender is irrelevant — same-sex couples are required to report as “married” if if they were legally married in a state or foreign country.

Note: For FAFSA purposes, your parents are considered “married” if they live their lives as a married couple. Physical distance between them, or living in a separate household, does not impact their “married” status as long as they do not live separate lives. A common example would be having a parent who has to live in a different state for employment purposes.

2. Who is my parent when my parents just live together?

If your parents are not married to each other but they live together, they both count (even if they are both of the same gender).

3. Who is my parent if my parent is widowed or never married?

If your parent is widowed or was never married, that is the parent who counts.

4. Who is my parent when my parents are divorced or separated?

It is not as easy to tell which parent counts when your parents are divorced or separated.

In a divorce, each party’s rights and obligations with respect to property, child support, child custody, child visitation rights, etc. are approved by a court. Separation is more tricky, as it could be legal or otherwise.

- In a legal separation, a court approves and orders the separation of a married couple, and each party’s rights and obligations as to child support, child custody, child visitation rights, etc. are spelled out. This is a common prelude to a divorce.

- In an informal separation, a married couple chooses to live separate lives, but their rights and obligations remain the same as if they are married. What’s key in these situations is not whether your parents are living together or separately, but whether they are living their own separate lives.

Who counts as your legal parent in these situations will depend on the underlying facts.

A. My parents are divorced or separated and don’t live together

If your parents are divorced or separated and don’t live together, the parent who counts depends on whether you are filling out the 2024-25 or the 2023-24 FAFSA.

For the 2024-25 FAFSA, the parent who counts is the one who provided more financial support during the last 12 months. If both your parents provided an exact equal amount of financial support during that time or if they don’t support you financially, then the parent who counts is the one with the greater income or assets.

For the 2023-24 FAFSA, the parent who counts is the one with whom you lived more in the past 12 months. But if the time you lived with your divorced or separated parents is the same, then the parent who counts is the parent who provided more financial support in the past 12 months or the most recent 12 months in which you actually received support from a parent.

B. My parents are divorced and live together

If your parents are divorced and live together, they both count — check off “Unmarried and both parents living together” on your FAFSA form.

C. My parents are separated and live together

If your parents are separated and live together, they both count — check off “Married or remarried” and NOT “Divorced or separated” in your FAFSA form.

5. Do I need to include my stepparent’s information for FAFSA?

Yes, if the parent who counts is remarried, you will need to include your stepparent’s personal and financial information. However, if that parent passed away and your stepparent did not legally adopt you, then your stepparent does NOT count.

6. Who is my parent when there has been a change in my parents’ marital status?

The picture gets even more fuzzy if your parents’ marital status has changed since they filed taxes for the year in question.

The key here is that you’re answering the FAFSA question on marital status “as of today”, i.e., the day you’re filling out the FAFSA form.

So, let’s walk through 3 possible scenarios and figure out the consequences of a change in marital status of one or both your parents. To illustrate, we will use the 2024-25 school year for your FAFSA application, which requires 2022 tax information.

Scenario 1 — Your parent (who counts) was NOT married in 2022 and didn’t file taxes as married. However, on the day you’re filling out the FAFSA form, that parent is married. This means that your stepparent’s 2022 income must be included on your FAFSA form.

Scenario 2 — Your parent (who counts) was married in 2022 and filed taxes as married. But the parent is no longer married on the day you’re filling out the FAFSA form. This means that your parent’s former spouse’s 2022 income must be deducted from your FAFSA form.

Scenario 3 — Your parent (who counts) was married in 2022 and filed taxes as married. But the parent is divorced and married to another person on the day you’re filling out the FAFSA form. This means that the former spouse’s 2022 income must be deducted, but the new spouse’s 2022 income must be added to your FAFSA.

7. How can my parents help me with my FAFSA form?

Once you know which parents count for FAFSA purposes, you should ask them to take the following steps.

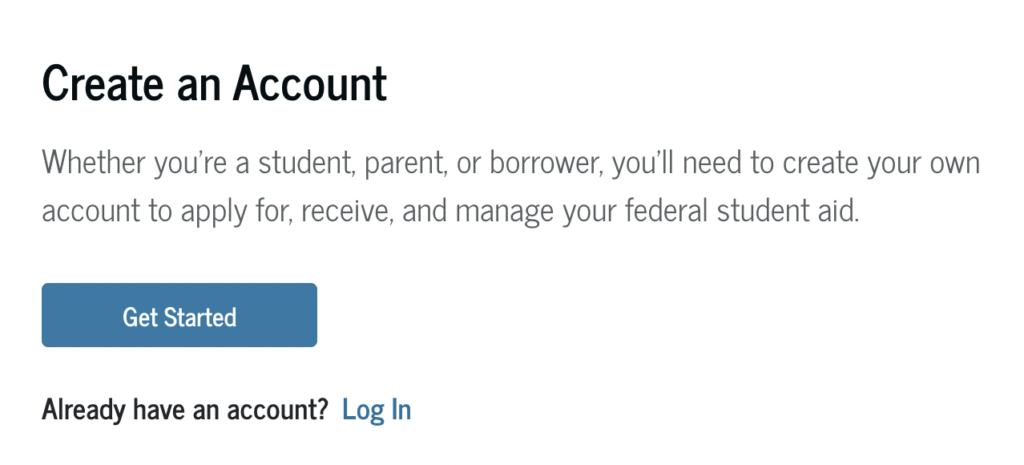

A. Create an FSA ID

One of your parents needs to create your FSA ID — a unique username and password combination — so he or she can sign your FAFSA form electronically. This will only take a few minutes.

To get started, your parent should go to the Create an Account page. Then, click on “Get Started” and follow the instructions.

Step 1 – Enter full legal name, date of birth, and Social Security number. Your parent’s name, date of birth, and Social Security number must MATCH EXACTLY the information on his/her Social Security card, so it ties in with their Social Security Administration’s records.

If your parent doesn’t have a Social Security number, he or she will still be able to create an FSA ID for the 2024-25 FAFSA. However, a parent without an SSN won’t be able to access the 2023-24 FAFSA. If that’s your situation, you should print out the signature page for your parent(s) to sign and send it by mail to the address provided in the FAFSA form.

Step 2 — Enter email address, username and password.

Step 3 — Enter mailing address, confirm if they wish to register a mobile phone number that they can use to reset password and retrieve username (provide the number if they do), and set their language preference.

Step 4 — Complete the “challenge questions and answers” segment. The information provided will be used to retrieve your parent’s password or username and to unlock his or her account.

Step 5 — Verify information. If there are any errors, select “PREVIOUS” and correct the errors. Otherwise, review the terms and conditions and click the box to accept them.

Step 6 — If your parent elects to register a mobile phone number, he or she will receive a secure code by text. Enter the code to verify the phone number.

Step 7 — Your parent will receive another secure code by email. Enter the code to verify email address and click “submit.” That’s it!

Note: Your parent’s email and mobile number can only be associated with his or her FSA ID.

If you have siblings in college, your parent(s) can use the same FSA ID as the one being used for you, but each of your siblings will need to create his or her own FSA ID.

Note: You need to create your own FSA ID, which allows you to sign your FAFSA form electronically, access the myStudentAid app, sign your loan contracts, and access your financial aid information online. You and your parents are NOT allowed to share FSA IDs.

B. Fill out parent information

Your parents are required to provide the following documents or information for the 2024-25 FAFSA form:

- Social Security number(s), or Individual Taxpayer Identification Number (ITIN)

- Tax returns for 2022 — IRS Form 1040 or 1040-NR

- Records of child support received

- Current balances of cash, savings, and checking accounts

- Net worth of investments, businesses, and farm (excluding the home they live in and retirement accounts)

For the 2023-24 FAFSA, your parent(s) will need to provide:

- Social Security numbers and birthdates

- Tax returns for 2021

- IRS Form 1040, 1040A, or 1040EZ

- Foreign tax return, if any

- Tax return for Puerto Rico, Guam, American Samoa, the U.S. Virgin Islands, the Marshall Islands, the Federated States of Micronesia, or Palau

- IRS W-2 form for 2021

- Records of untaxed income — such as child support received, interest income, and veterans noneducation benefits, etc.

- Cash information and savings and checking balances (from bank statements

- Investments information – such as real estate, stocks and bonds, business and farm assets, etc. (excluding the home they live in and retirement accounts)

An easy way to complete the financial information is to select the Internal Revenue Service Data Retrieval Tool (IRS DRT), so the tax information is automatically transferred to your FAFSA form. You can check here to find out when the tax return information will likely be available via IRS DRT.

Note: If your parents are filling out the parent section for the 2023-24 FAFSA, the easiest way to ensure that all of you have access to your FAFSA form is to create a temporary password — a “Save Key” — almost right away when you start your FAFSA form and share it with your parents. The “Save Key” also allows you to save your FAFSA form without finishing it and return to it later.

Have your parents collect their documents they need ahead of time, so your application process can go smoothly.

If the financial situation has changed significantly since your parent(s) filed taxes for the year in question, have them answer the FAFSA questions as required, submit the FAFSA form, and then call the financial aid office at your intended/present college to explain your situation.

8. What if I cannot provide parent information on my FAFSA form?

Although the FAFSA form requires parent information if you are a dependent student, there are certain exceptions.

A. I can’t provide parent information due to special circumstances

If you can’t provide parent information due to special circumstances, including your parents’ incarceration, you can indicate that on your FAFSA form.

On your FAFSA form, answer “Yes” to the question “Do unusual circumstances prevent the student from contacting their parents or would contacting their parents pose a risk to the student?”.

Next, when you are given an explanation of what falls under special circumstances, select the choice that best fits your situation.

You can submit your application without providing parent information, but you should immediately contact your college’s financial aid office to explain your situation.

You may be asked to provide additional information to support your claim of special circumstances, so try to collect documents from the applicable court or law enforcement, documentation from an attorney, and any other relevant information.

B. I can’t provide parent information because my parents refuse to give their information

Sometimes, parents are not willing to help their children with their FAFSA form. If your parents refuse to provide their information, you can indicate that on your FAFSA form.

First, answer “Yes” to the question “Are the student’s parents unwilling to provide their information, but the student doesn’t have an unusual circumstance that prevents them from contacting or obtaining their parents’ information?”.

Next, select the option that states you don’t have a special circumstance but you still can’t provide parent information.

Note: If you are using the app to apply, select the option that you would like to be considered for unsubsidized loans, which require you to pay interest even when you’re in school, in grace period, or in deferment.

You can submit your application without providing parent information, if you agree that you will not be eligible for any federal student aid — grants, work-study programs, and federal student loans — other than unsubsidized loans, and that the decision to award unsubsidized loans will be made by the financial aid office at your college.

Your FAFSA information will then be sent to the colleges you list, but you won’t receive an SAI (or EFC in the case of 2023-24 FAFSA), so you must immediately contact your college’s financial aid office to explain your situation and find out if it’s possible for you to get an unsubsidized loan.

The financial aid office will then determine if you qualify for an unsubsidized loan. This decision is final and cannot be appealed to the Department of Education.

9. What if my non-U.S. citizen parents are afraid of providing information to FAFSA?

The FAFSA form doesn’t ask about your parents’ citizenship status, so reassure them that they should not be concerned. Their citizenship status will not affect your financial aid eligibility.

10. How do I fill out non-U.S. citizen parent information on the FAFSA form?

For the 2024-25 FAFSA, parents who do not have a Social Security number can still fill out the form without providing it. They can fill out their Individual Taxpayer Identification Number (ITIN), if they have one, or skip that field too.

For the 2023-24 FAFSA, parents can simply enter “000000000” — no dashes — instead of the typical 9-digit Social Security number. They should not use their Taxpayer Identification Number for this purpose. If your parents don’t have a Social Security number and they live in the Federated States of Micronesia, the Republic of the Marshall Islands, or Palau, otherwise known as the “Freely Associated States” (FAS), they should enter “666” as the first three digits and leave the remaining six positions of the Social Security number field blank. Once your application is processed, the last six digits will be assigned to you. If you receive a 9-digit number beginning with “888” instead, simply replace the “888” with “666” and use the last 6 digits.

Note: Keep this number somewhere safe, so you can use it for your FAFSA renewal.

Also, as mentioned above, if your parent does not have a Social Security number, he or she will still be able to create an FSA ID for the 2024-25 FAFSA. However, a parent without an SSN won’t be able to access the 2023-24 FAFSA. If that’s your situation, you should print out the signature page for your parent(s) to sign and send it by mail to the address provided in the FAFSA form.

A. My parents do not live in the United States

If your parents live in a country other than the United States, they should select their country from the dropdown menu.

B. My parents do not file taxes in the United States

If your parents live in a foreign country and file taxes in that country, but not in the United States, they must convert the amounts on the foreign tax return into U.S. dollars, using the published exchange rate for the date closest to your FAFSA completion date. You can get the daily exchange rate here.

If your parents live in a U.S. territory or one of the FAS, they should use the information from that tax return to fill out the FAFSA.

C. My parents do not file taxes

If your parent(s) don’t file taxes at all, select “Not going to file” where the FAFSA form asks whether the parent(s) have filed taxes. You will then be asked to provide information about how much your parent(s) earned from work instead of specific information from tax forms.

The bottom line

The FAFSA form is your gateway to financial aid, so be sure to get your parents’ information right. For more tips on how to complete your FAFSA form correctly and on time, check this FAFSA complete guide.

For further insights and resources on the financial aid process and other higher education topics, be sure to check out TUN AI, our AI-powered platform for personalized guidance.