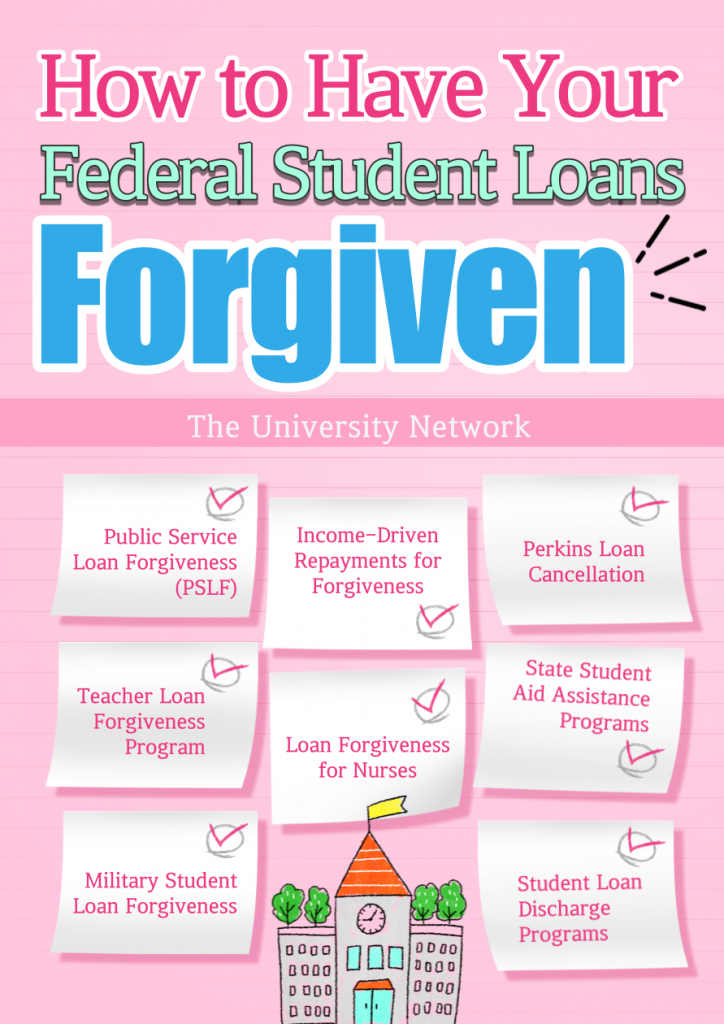

Having your federal student loans forgiven may seem like something out of a fairy tale. But it is, in fact, possible.

That said, successfully having your loans forgiven can be an extremely confusing task, full of barriers and stipulations. To make things easier for you and save you the preliminary research, we’ve broken down many of the most popular and secure ways that you could have your student loans forgiven and provided tips to improve your chances of forgiveness.

Public Service Loan Forgiveness (PSLF)

PSLF is a program that was created in 2007 to encourage skilled college graduates to pursue careers in the public service sector. The idea is that qualifying borrowers working a full-time (30+ hours a week) public service job are eligible to have their loans forgiven after 120 qualifying payments. If paid on time, this should take 10 years.

What are the eligibility requirements for PSLF?

- PSLF is only available to those with federal student loans called Direct Loans. All loans included in the William D. Ford Federal Direct Loan (Direct Loan) Program qualify. Examples of qualifying loans include Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans, and Direct Consolidation Loans.

Loans from the Federal Family Education Loan (FFEL) Program and the Federal Perkins Loan (Perkins Loan) Program do not qualify for PSLF. But, according to the Department of Education, you may become eligible if you consolidate your FFEL or Perkins loans into a Direct Consolidation Loan. It’s important to note, though, that any payments you made on your loans before you consolidated them don’t count.

- For at least 10 years, you must be employed by a U.S. federal, state, local, or tribal government, work for an eligible not-for-profit organization, or be a full-time AmeriCorps or Peace Corps volunteer. Government jobs include public school teachers and employees, law enforcement officers, and those in public law and public health, among others.

In most scenarios, you must work at a not-for-profit organization that is tax-exempt under Section 501(c)(3) of the Internal Revenue Code to qualify for PSLF. In some cases, though, you can qualify for PSLF if you work for a not-for-profit organization that is not tax-exempt but provides certain types of qualifying public services. More information about these not-for-profit organizations can be found here.

- You should have a repayment plan that is income-driven, meaning your monthly payment is based on your monthly income. Eligible plans include an Income-Based Repayment plan, an Income-Contingent Repayment plan, a Pay As You Earn Repayment plan, or a Revised Pay As You Earn repayment plan.

Payments made under a 10-year standard repayment plan also qualify. However, under the 10-year standard repayment plan, you would have paid off all of your loans once you’ve made all of the 120 required payments for PSLF. So, there won’t be any loan balance left to forgive. If you want to receive PSLF, you need to change to an income-driven repayment plan.

- You must make 120 “qualifying payments” before you’re eligible to have your loans forgiven through PSLF. To be considered a “qualifying payment,” payments must be made after October 1, 2007, must be made under a qualifying repayment plan, must be for the full amount due as shown on your bill, must be made no later than 15 days after your due date, and must be made while you are employed full-time by a qualifying employer.

Note: You can only make qualified monthly payments when you’re required to make a payment. So, you can’t make a qualifying monthly payment while your loans are in an in-school status, the six-month grace period after graduation, a deferment, or forbearance.

For a full list of eligibility requirements and details, check out the Department of Education’s PSLF page.

How to best ensure you get approved for PSLF

Notably, borrowers have greatly struggled to receive PSLF. As of April 2020, 180,798 applications for PSLF have been processed. Out of those, 177,422 have been rejected and 3,376 have been approved.

So, to make sure you’re on the right track, the Department of Education suggests that you submit a Public Service Loan Forgiveness: Employment Certification Form each year or when you change employers.

The government can then use the information you provide on the form to let you know if you’re making the right payments and doing everything you need to do to have your student loans forgiven.

Borrowers who believe they are eligible to receive PSLF can use the form, but the Department of Education mandates that those who switch jobs fill out the form when they do. If you fail to submit the Employment Certification Form when you switch employers, you’ll have to fill out a separate form for each employer you worked for while making the 120 qualified monthly payments when you do apply for PSLF.

The Department of Education also offers a PSLF help tool, which can:

- Help you understand more about the PSLF program and what you need to do to boost your chances of having your loans forgiven;

- Help you better determine whether your employer qualifies for PSLF;

- Help you better determine whether your loans qualify for PSLF;

- Help you decide which PSLF form to submit;

- “Generate a partially completed form for you to take to your employer to sign, and then for you to submit to FedLoan Servicing”; and

- Use the information the department has about your federal student loans to explain other actions you should or must take if you want to receive PSLF.

If you are eligible for PSLF and have made the 120 qualifying payments, it is time to apply for PSLF. You can access the application document here.

In most cases, you need to mail the filled application to this address:

U.S. Department of Education

FedLoan Servicing

P.O. Box 69184

Harrisburg, PA 17106-9184

But if FedLoan Servicing is your provider, you can upload your application directly to FedLoan Servicing’s website.

Those who qualify to have their loans forgiven will be notified that their entire remaining balance of eligible Direct Loans will be forgiven. That includes all outstanding interest and principal. And if you made additional payments, after your necessary 120 qualifying payments, those extra payments will be refunded to you.

If your PSLF application is denied because some of your payments were not made under a qualified repayment plan, you still may be eligible to receive relief through the Temporary Expanded Public Service Loan Forgiveness program (TEPSLF). However, only a very small number of these requests are approved.

If you still have any questions or concerns about the PSLF process, it may be helpful to check out the Department of Education’s PSLF FAQs.

Income-Driven Repayments for Forgiveness

If you’re on an income-driven repayment plan and make on-time payments for 20-25 years, depending on the plan, you’ll have your remaining loan balance forgiven after that period of time. It doesn’t matter which field you work in.

There are four income-driven repayment plans:

- Income-Based Repayment (IBR) plan;

- Income-Contingent Repayment (ICR) plan;

- Pay As You Earn (PAYE) Repayment plan; and

- Revised Pay As You Earn (RPAYE) repayment plan.

Forgiveness under Income-Driven Repayment plans

The IBR plan qualifies you for forgiveness after 25 years of on-time payments, but is also only available to those who demonstrate that they can’t afford payments under the standard 10-year repayment plan.

The ICR plan also qualifies you for forgiveness after 25 years of on-time payments. You don’t have to demonstrate financial hardship. It is available to any borrower with eligible federal loans.

The PAYE plan qualifies you for loan forgiveness after 20 years of on-time payments. This plan is only available for those who demonstrate financial distress to the point that they can’t afford to make payments under the standard 10-year repayment plan, but borrowers can remain in the program after their financial hardship is resolved.

The REPAYE plan qualifies you for loan forgiveness after 20 years of on-time payments if you’re repaying for undergraduate study, or 25 years if you’re repaying for graduate or professional study. The REPAYE plan is similar to the PAYE plan, but you don’t have to demonstrate financial hardship. It is available to any borrower with eligible federal loans.

Applying for income-driven repayment plan

Consistent on-time payments under any income-driven repayment plan will qualify you for loan forgiveness. However, if you aren’t currently on an income-driven repayment plan, you’ll need to apply.

Reach out to your loan servicer if you have questions. They can help you decide which income-driven repayment plan is right for you.

From there, you’ll need to submit an application called the Income-Driven Repayment Plan Request. You can either submit it online or on a paper form, which you can get from your loan servicer.

For additional information, check out the comprehensive guide offered by the Department of Education.

Perkins Loan Cancellation

Certain borrowers with federal Perkins Loans can have 100% of their student debt canceled if they work in a public service job for five years. In most instances, those who qualify for Perkins Loan cancellation will see a percentage of their loans incrementally canceled.

Most cancellation periods are five years. And, typically, you’ll have 15% of your loans canceled per year for the first and second years of working, 20% for the third and fourth years, and 30% for the fifth year. Each amount includes the interest that accrues during that period.

What are the vocation eligibility requirements for Perkins Loan Cancellation?

Borrowers working the following jobs are eligible for a certain percentage of loan cancellation:

- Full-time teacher of specific subjects in a teacher shortage area or educational service agency serving low-income students: Up to 100%

- Full-time nurse or medical technician: Up to 100%

- Full-time firefighter: Up to 100%

- Full-time qualified professional provider of early intervention services for the disabled: Up to 100%

- Full-time faculty member at a tribal college or university: Up to 100%

- Full-time speech pathologist with master’s degree working in a Title I-eligible elementary or secondary school: Up to 100%

- Librarian with a master’s degree working in a Title I-eligible elementary or secondary school or in a public library serving Title I-eligible schools: Up to 100%

- Full-time law enforcement or corrections officer: Up to 100%

- Full-time attorney employed in a federal public or community defender organization: Up to 100%

- Full-time employee of a public or nonprofit child- or family-services agency providing services to high-risk children and their families from low-income communities: Up to 100%

- Full-time staff member in the education component of a Head Start program: Up to 100% (over seven years)

- Full-time staff member in the education component of a prekindergarten or child care program that is licensed or regulated by a state: Up to 100% (over seven years)

- Military service in the U.S. armed forces in a hostile fire or imminent danger pay area: Up to 100%

- AmeriCorps VISTA or Peace Corps volunteer: Up to 70% (over four years)

The Perkins Loan program expired on September 30, 2017. But if your loans were taken out before that day and you’ve worked one of the jobs listed above for at least one year, you’re likely eligible to have at least a portion of your Perkins Loans forgiven.

It is worth noting, though, that some of the jobs on the list were added to the program in August 2008. So your work experience in those fields prior to August 2008 won’t make you eligible.

The jobs that were added in August 2008 include:

- Firefighter;

- Faculty member at a tribal college or university;

- Speech pathologist;

- Librarian;

- Public defender;

- Early childhood education staff member; and

- Military service in the U.S. armed forces in a hostile fire or imminent danger pay area.

How to best ensure your Perkins Loans get canceled

The application process for Perkins Loans cancellation is most often run through your college or university, not the Department of Education.

So, if you’re interested in having your Perkins Loans canceled, it would benefit you to reach out to your school’s financial aid office. They can help you understand the process and ensure that you’re eligible.

Once you’ve completed a year’s worth of work in one of the positions listed above and are ready to apply, call your school’s financial aid office again and ask about the next steps. Likely, your school will send you an application form. Or, if they outsource loans, they will likely put you in contact with your loan servicer.

Since Perkins Loans are offered through institutions, cancellation application forms may vary. But, they all typically ask you to provide proof of employment in your specific job and a signature from your employer.

Unfortunately, since Perkins Loans are forgiven in annual increments, you’ll need to fill out a new form each year.

Filling out these forms can be tricky, and any slip-up may prevent you from having your loans canceled. So, it’s important to routinely check back in with your school’s financial aid office to make sure you’re doing everything correctly.

Teacher Loan Forgiveness Program

If you’re a teacher, there are a few potential avenues, depending on your circumstances, through which you can have your student loans forgiven. You may qualify through PSLF, Perkins Loan cancellation, or the Teacher Loan Forgiveness Program.

The Teacher Loan Forgiveness Program was first created in 1998 to encourage skilled teachers to take jobs at elementary, middle, and high schools that serve low-income students. The idea is that teachers, who teach full-time for at least five consecutive and complete years at a qualifying low-income school or educational service agency, may be eligible to have up to $17,500 of their loans forgiven.

What are the eligibility requirements for Teacher Loan Forgiveness?

- To be eligible for Teacher Loan Forgiveness, you must have federal Direct Loans or Stafford loans. Private student loans, Parent PLUS or Grad PLUS loans, and Perkins Loans are not eligible for this type of forgiveness.

- You must have had an outstanding balance on your Direct loans or Stafford Loans as of or after October 1, 1998.

- You must have been employed as a full-time teacher for at least five consecutive, complete years. At least one of those years must be after the 1997-98 academic year.

- You must be considered a “highly qualified” teacher. This means you must have obtained at least a bachelor’s degree, received full state certification as a teacher, and “not had certification or licensure requirements waived on an emergency, temporary, or provisional basis.” There are additional requirements that teachers must meet depending on whether they teach at the elementary or secondary level. A full list of those requirements is available here.

- You must have taught at a qualifying low-income school or educational service agency. The full list of eligible schools and agencies is published by the Department of Education each year. If you have any questions about the inclusion or omission of a particular school or agency, you can direct a question to the state education agency contact in the state where the school is located.

How to best ensure your student loans are forgiven under Teacher Loan Forgiveness

The exact amount of money you’ll be eligible to have forgiven depends on the subjects and grade levels that you teach. Highly qualified secondary math, science, and special education teachers are eligible to have up to $17,500 forgiven, while highly qualified elementary and secondary school teachers that teach other subjects can get up to $5,000 forgiven.

You can apply for Teacher Loan Forgiveness by submitting a Teacher Loan Forgiveness Application to your loan servicer after you’ve completed five consecutive, complete years of qualifying teaching.

The certification section of the form must be completed by the chief administrative officer, such as the principal or superintendent, at the school or educational institution where you taught or teach. And if you are applying forgiveness of loans from multiple loan services, you must submit a separate form to each of them.

The best thing you can do to make sure you’re on track to receive teacher loan forgiveness is to routinely check all of the eligibility requirements and make sure you qualify.

For a full list of eligibility requirements and details, visit the Department of Education’s Teacher Loan Forgiveness page.

Loan Forgiveness for Nurses

Like teachers, nurses are eligible for loan forgiveness through PSLF and Perkins Loan Cancellation.

In addition, they qualify for the Health Resources and Services Administration’s (HRSA) NURSE Corps Loan Repayment Program, a highly competitive but rewarding program, which pays up to 85% of unpaid education debt for registered nurses, advanced practice registered nurses, or nurse faculty in exchange for dedicating at least two years of their lives to work in underserved communities at critical shortage facilities (CSF) or serving as nurse faculty in an eligible school of nursing.

Those accepted to the program, who work at least 32 hours per week at a public or private nonprofit CSF or are employed as a full-time nurse faculty member at a public or private nonprofit, eligible school of nursing, can have 60% of their student loans forgiven over the course of their two years of employment. Those who opt to work a third year may have an additional 25% forgiven.

Applications are accepted once a year. This year’s deadline was on March 12.

What are the eligibility requirements for HRSA’s loan forgiveness for nurses?

According to HRSA, to be eligible, applicants must:

- Be a U.S. Citizen (either U.S. born or naturalized), U.S. National, or Lawful Permanent Resident;

- Be a licensed registered nurse, advanced practice registered nurse, such as a nurse practitioner in the state you wish to practice, or be a nurse faculty member with qualifying nursing debt;

- Have received your nursing education from an accredited school of nursing located in a U.S. state or territory;

- Have employment as a scheduled full-time RN or APRN working at least 32 hours per week at a public or private nonprofit CSF, or be employed as a full-time nurse faculty member at a public or private nonprofit, eligible school of nursing;

- Have outstanding qualifying educational loans (defined below) incurred while seeking a diploma or degree in nursing; and

- Have a current, full, permanent, unencumbered, unrestricted license to practice as an RN, or an APRN if applicable, in the state in which you intend to practice, or be authorized to practice in that state pursuant to the Enhanced Nursing Licensure Compact (eNLC).

How to best ensure your student loans are forgiven under HRSA’s loan forgiveness for nurses

This is a competitive program with an extensive application. So, before applying, make sure you check out the full Application and Program Guidance available on the HRSA’s website.

Any additional questions can be addressed directly to the HRSA. The organization’s number is 1-800-221-9393.

If you’re ready to apply, you can submit your application through the Bureau Health Workforce Customer Service Portal.

In addition to filling out an application, you must provide a number of supporting documents, such as proof of citizenship, transcripts and loan documents, among other things. You can see a full list of the documents you need to provide on the full Application and Program Guidance.

State Student Aid Assistance Programs

Each state offers at least one student loan forgiveness program to benefit its resident borrowers. Most often these programs are available for those working in high-demand professions, such as teachers, nurses, doctors, or lawyers.

Georgia, for example, offers a number of student debt relief programs that assist physicians, dentists, physician assistants, and advanced practice registered nurses who work in underserved rural counties.

And Illinois offers the Teachers Loan Repayment Program — just one of the state’s many student debt assistance programs — that assists teachers who opt to work in low-income areas.

The list goes on. So, if you’re interested in seeing which student debt relief options your state offers, reach out to your state’s higher education department and ask about what is available.

Military Student Loan Forgiveness

If you’re a member of, or thinking about joining, the U.S. Armed Forces, you may have many options to alleviate some or all of your student debt.

The Army, Navy, Air Force, National Guard, and Coast Guard all offer some sort of student loan forgiveness program. Those in the U.S. National Guard, for example, may qualify to receive up to $50,000 in student debt relief. And those in the Navy could have up to $65,000 of their student loans relieved.

For details, check each branch’s program below:

Student Loan Discharge Programs

In rare circumstances, such as a school closure or permanent disability, borrowers may be able to have their students loans discharged.

Closed School Discharge

If your college or university closes while you’re enrolled, while you’re on an approved leave of absence, or within 120 days after you withdraw, you may be eligible to have 100% of your federal student loans discharged.

If this happened to you, you can contact your loan servicer about the application process of having your loans discharged.

Note: You must continue to make payments while your discharge application is being processed.

For more information, see the Department of Education’s guidelines.

Borrower Defense to Repayment Discharge

Borrowers with federal direct loans may be eligible for forgiveness of their loans used to pay for college if their school misled them about job placement rates or average earnings post-graduation, or engaged in other misconduct in violation of certain state laws.

At this point, those who think they’ve been defrauded and want their loans discharged must submit their application using one of the Department of Education borrower defense application forms.

In addition to filling out the application, you must provide additional documents. The Department of Education suggests that the following documents would be helpful:

- Documentation to confirm the school for which you are applying for borrower defense, your program of study, and your dates of enrollment (such as transcripts, enrollment agreements, and registration documents);

- Promotional materials from the school;

- Emails with school officials; and

- Your school’s manual or course catalog.

For more information, see the U.S Department of Education’s guidance.

Permanent Disability Discharge

If you’ve been totally and permanently physically or mentally disbaled and are unable to work, you may qualify for a total and permanent disability (TPD) discharge of your federal student loans.

To be deemed eligible, you’ll have to fill out an application and provide documentation that verifies your disability. Once you’ve been deemed eligible, the government will monitor your situation for three years. And if you do not meet requirements, your loans may be reinstated.

For more information, see the Department of Education’s guidelines.

Conclusion

Student loans can be a huge burden, particularly early on in your professional career when you aren’t making as much money. Although having student loans forgiven is a huge challenge, it is possible if you follow the guidelines listed in this article.