College education in the United States is getting more and more expensive, and students are borrowing more than ever to pay for their education.

Student debt has reached a high of $1.6 trillion, with the average undergrad borrowing about $30,000. Unfortunately, most students do not know how to manage their student debt successfully because they haven’t been given adequate financial education to help them do so.

So, if you need to borrow money for school (like I did), be smart about it.

First, explore all the options available to you — grants, scholarships, federal student loans and work-study programs available at your school — and take advantage of free money and loans bearing lower interest (in that order). You need to complete the FAFSA (Federal Application for Federal Student Aid), so colleges can use the data to assess your financial need.

For extra spending money, consider part-time jobs that will accommodate your school commitments.

Next, if these sources are not enough and you still need to take out private student loans, learn all about it before you decide that you want to carry more student loan debt. And only borrow what you need for your education. Don’t take on more debt just to finance a lifestyle.

Here’s what you need to know before you make your decision:

1. What are private student loans?

Unlike federal student loans, which are issued and guaranteed by the U.S. Department of Education and managed by an assigned loan servicer, private student loans are issued by private lenders — banks, credit unions and investors who provide funding to online lenders — and are not guaranteed by the federal government.

Like federal student loans, private student loans must be used for educational purposes, such as tuition, room and board, fees, books, computers and electronics for school, supplies and equipment, transportation, and personal needs at school.

2. What types of interest rates do private student loans offer?

Most private lenders offer borrowers a choice of fixed or variable APR (annual percentage rate).

When the interest rate is fixed, the rate doesn’t change, so your monthly payments will always be the same amount. Knowing how much you need to pay each month will help you with your budget.

When the interest rate is variable, however, your monthly payments will vary because the interest rate is tied to the market and can go up or down. Because of the potential for the interest rate to go up, it could be risky to choose variable APR.

3. How are interest rates on private student loans determined?

Generally, the interest rates on private loans are based on the strength of your credit score or history, so a credit check is required. The better your credit score or history, the lower the risk you pose to lenders and the more advantageous the rate you get.

In contrast, the interest rates on federal student loans generally are not contingent on your credit score or history. Borrowers of the same type of federal student loans get the same interest rate. Keep in mind, however, that federal Grad PLUS (for graduate and professional students) and Parent PLUS loans (for parents of dependent undergraduate students) do require a credit check.

Also, interest for private student loans accrues while borrowers are still in school. In contrast, the federal government pays the interest on subsidized federal loans while a student is still enrolled in school, in deferment, or under a “grace period.” Interest on unsubsidized federal loans, however, accrues while students are still enrolled.

Most private lenders offer students the option to defer payments while they’re still enrolled in school. But, if you can afford it, you should make in-school payments to lower your total repayment costs.

4. Why is creditworthiness important?

As mentioned above, a credit check is required for private student loans and federal Direct Plus loans. When your credit is pulled, banks and institutions can see your credit history and your credit score.

Your credit history is, essentially, your financial record showing how you handled payments of debt. It takes time to build a solid credit history, so you should start, if you haven’t already.

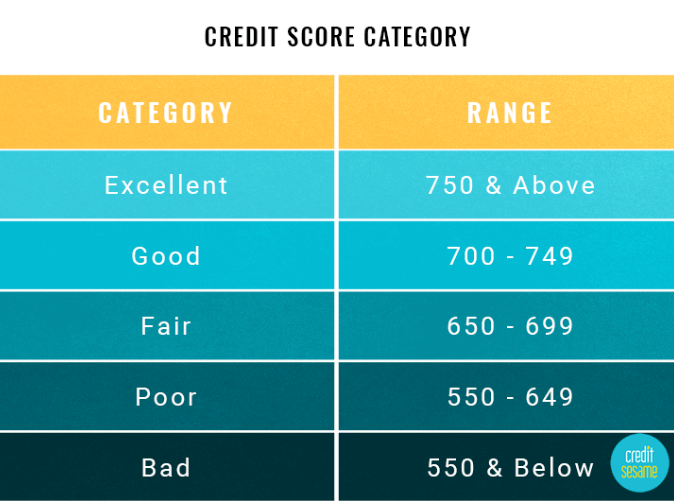

A credit score is a three-digit number — ranging from 300 to 850 — that banks and institutions use to determine how financially responsible you are and whether to issue you a loan or credit card. Below is a chart that shows what affects your credit score.

A higher score not only improves the odds of having your application approved, but also makes you eligible for lower interest rates. A lower score, on the other hand, reduces your chances of getting a loan and translates into higher interest rates.

Generally, a credit score of 750 and above is considered excellent, and 700 and above is considered good. Below is a chart of the various categories of credit score.

If you don’t know your credit score, you can check for free with Credit Karma or Credit Sesame. It’s important that you do this ahead of time, so you can fix any issues that may pop up on your credit report. And be wary of offers to help you with credit problems; use these tips instead to repair your credit yourself.

5. Do you need a cosigner?

As mentioned above, it takes time to establish a credit history. Unfortunately, most students haven’t had time to build one when they first enter college. That, coupled with a lack of income, means that it is difficult for most students to get a private student loan on their own.

But don’t worry if you are in that position. In most cases, you can still get a loan if you can find someone – usually, it’s a family member — to apply for a loan with you and agree to pay off the debt if you don’t make payments when they’re due. Ideally, your cosigner is someone with a strong credit, which will make your application more attractive to private lenders and potentially lower your interest rate.

Whoever cosigns your loan is taking a huge risk on your behalf, so act responsibly. Make your payments on time, so you don’t damage your cosigner’s credit. Keep in mind also that your cosigner is on the hook if you stop making payments, and that, by cosigning your loan, your cosigner may find it difficult to get a loan if he or she should need it.

Cosigners are responsible for the life of the loan, but you should find out from your lender the circumstances under which you can release your cosigner from your loan and work towards that goal. For example, with SunTrust Bank, the cosigner release option is available after a borrower makes 36 on-time payments.

6. What are the repayment terms?

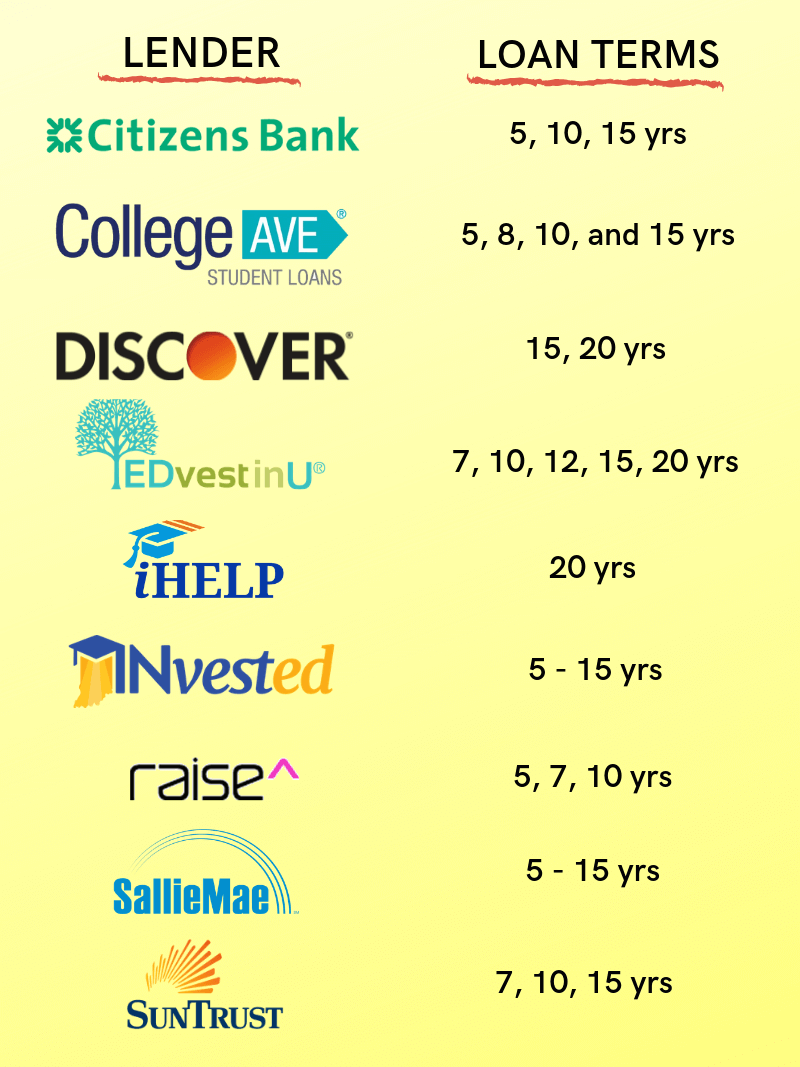

While the standard repayment term for federal student loans is 10 years, private lenders typically offer a range of repayment terms.

Private lenders offer loans from 5 to 20 years. The graphic below shows some examples of what’s being offered.

Unlike federal student loans, which let you choose your repayment term after you graduate (or leave school), private student loans require that you choose before receiving your loan.

By choosing a shorter term loan, you are more likely to get a lower interest rate. You will pay off your loan faster and pay less in interest. But, you will have larger monthly payments.

The reverse is true of longer term loans.

Your actual repayment terms and the interest rate will depend on your creditworthiness and that of your cosigner, if you have one.

7. How much can you borrow?

Since private student loans are meant to be used only for educational purposes, the maximum loan amount for an academic year is determined by the costs of your school, minus federal student loans, grants, scholarships, or other financial aid you get.

Your ability to pay back the loan will also be a factor in determining how much you can borrow.

Most lenders also set a limit on how much you can borrow. For example, SunTrust has a maximum annual amount of $65,000 for undergraduate and graduate students ($95,000 for graduate business students), and an aggregate maximum student loan debt of $150,000 for undergraduate and graduate students ($180,000 for graduate business students).

Your goal, however, is to borrow as little as possible, so you graduate with the least amount of debt. This is particularly important for undergraduate students who intend to pursue a higher degree in law, medicine or business, and have to borrow then. You don’t want to add debt on top of debt.

8. What is the right private student loan for you?

There’s no magic answer. You need to put in the time to research and compare what different lenders offer to someone in your particular situation.

Check each lender’s terms carefully and compare them against others. An organized way of accomplishing this is to create a spreadsheet, listing the amount you’re considering borrowing and what each lender is offering you in terms of fixed and variable interest rates, repayment terms, repayment options, fees (application, origination or prepayment), total repayment costs, cosigner release options, rate reductions for automatic payments, special rewards etc. For example, SunTrust offers a 2% principal reduction as a graduation reward to borrowers of its Custom Choice Student Plan, while Discover offers both a 2% graduation reward and a 1% cash reward of the loan amount for good grades.

Check with your school for recommendations on private lenders.

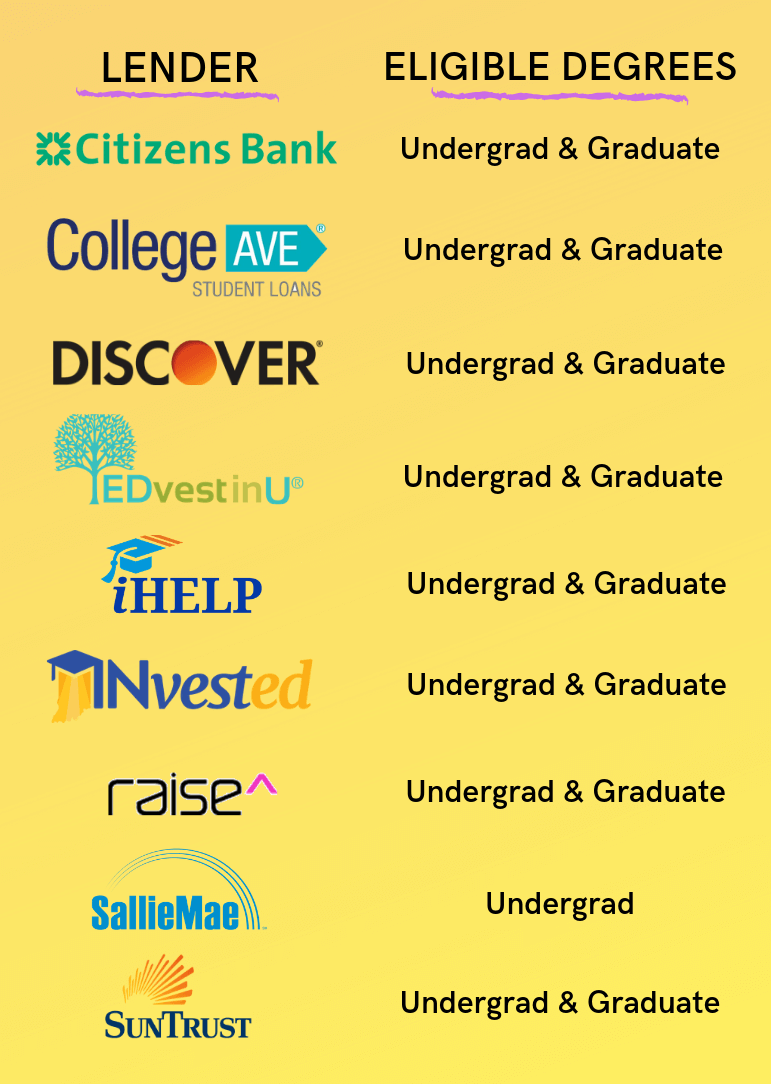

If your school doesn’t work with a particular lender, start your research with some of these banks — Discover, Citizens Bank, CollegeAve, EDvestinU, Sallie Mae and SunTrust — to get an idea of what some better known lenders offer.

9. What are the disadvantages of private student loans?

Private student loans fill the gap between the financial aid you get and the costs of education.

But, private student loans don’t carry the benefits that come with federal student loans, such as the Public Service Loan Forgiveness (PSLF) and the TTeacher Education Assistance for College and Higher Education (TEACH) Grant.

In addition, if borrowers have problems making their monthly payments on their federal student loans, they have the option to apply for deferment or forbearance, or to have their monthly payment adjusted based on their discretionary income (income-driven repayment plans).

Some private lenders will help borrowers temporarily manage your loan payments if they’re having payment problems. For example, Discover has several options in place. Under the Reduced Payment and Hardship options, borrowers have a lower regular monthly payment. The other four options push back the regular monthly payments, but interest will continue to accrue.

The bottom line

Try not to take on more student debt, if possible. But, if you have determined, after thorough research, that you absolutely need private student loans to fund your education, make sure you choose the right loan with the right lender. Then, once you’ve borrowed the loan, act responsibly and make sure that you do not run afoul of the terms of the loans — that includes being enrolled at least part-time to qualify for loans each academic year.