Finance majors are in high demand, as nearly every institution needs someone to help analyze financial data and make financial decisions. Understandably, analytical skills are must-have for those aspiring to work in finance. But, the best finance workers also have great communication skills, so they can effectively explain financial matters to a company’s decision makers who may not have a background in finance.

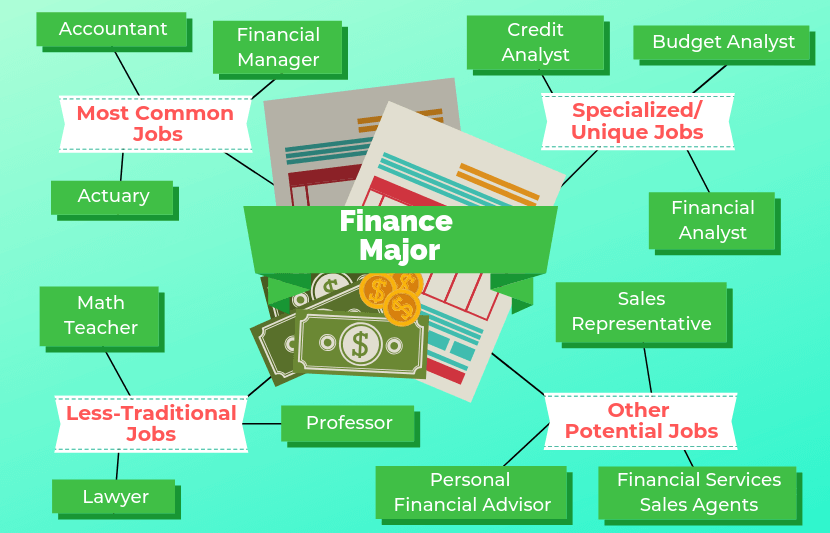

Here is a list of 12 possible jobs for finance majors:

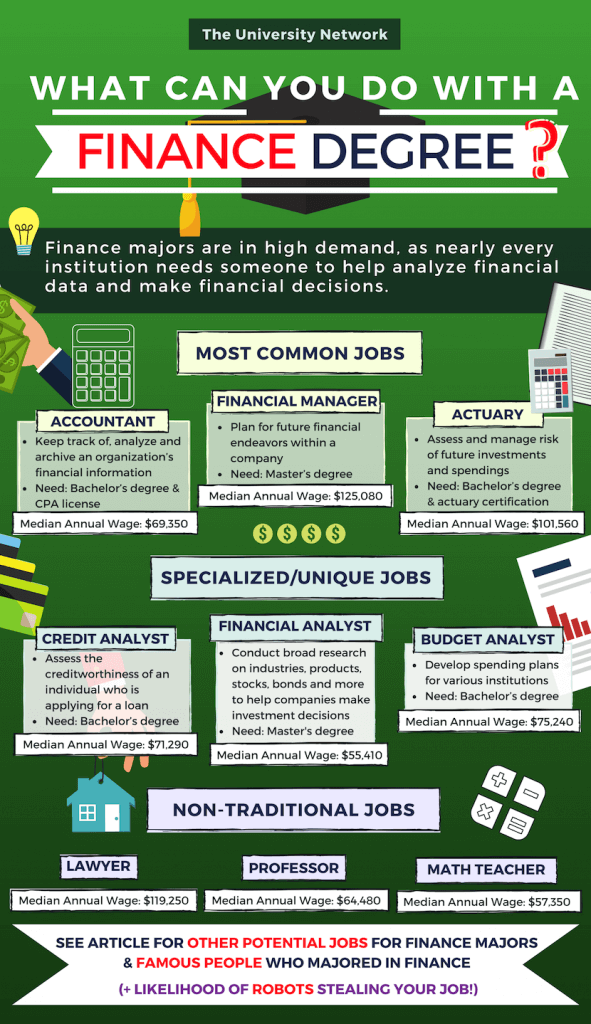

Common Jobs For Finance Majors

1. Accountant

Accountants keep track of, analyze and archive an organization’s financial information. Depending on the size of the organization, accountants are also sometimes asked to give advice on how an organization should budget, spend and invest its money. Nearly every organization needs accountants, including hospitals, nonprofits, insurance firms, and more. After completing a bachelor’s degree, aspiring accountants should become state-certified by passing the Certified Public Accountant exam, which is administered by the American Institute of Certified Public Accountants.

Median annual wage: $69,350

Common entry-level degree: Bachelor’s degree & CPA license

Likelihood that robots will take your job: 94%

2. Financial Manager

Some of the day-to-day tasks of financial managers might overlap with accountants, but there is one key difference between the two jobs. Financial managers are supposed to plan for future financial endeavors, while accountants are more regularly required to analyze and share past financial information with a company. In smaller organizations, one person may be required to do both jobs. Most financial managers have a master’s degree and a significant amount of work experience within the field of finance

Median annual wage: $125,080

Common entry-level degree: Master’s degree

Likelihood that robots will take your job: 7%

3. Actuary

Actuaries may also have similar responsibilities to accountants, as they both are part of a company or organization’s finance department. But while accountants spend more time drafting financial reports on past spendings, actuaries assess and manage risk of future investments and spendings. To become an actuary, you need a bachelor’s degree in a related field, which could be finance, business, economics, accounting, etc., and you have to pass certification exams. Professional actuaries should be certified through the Casualty Actuarial Society (CAS) or the Society of Actuaries (SOA). Both groups have a unique set of tests you have to pass. If you recently graduated from college and want to become an actuary, now is the time to start preparing for those tests. They can take hundreds of hours to prepare for.

Median annual wage: $101,560

Common entry-level degree: Bachelor’s degree & actuary certification

Likelihood that robots will take your job: 21%

Specialized, Unique Jobs for Finance Majors

4. Credit Analyst

Generally, credit analysts are tasked with assessing the creditworthiness of an individual who is applying for a loan. Most commonly, they work for banks, investment companies and any institution that issues credit cards. Credit analysts must be good mathematicians, researchers, analyzers and communicators — because they spend a lot of time interacting with individual people.

Median annual wage: $71,290

Common entry-level degree: Bachelor’s degree

Likelihood that robots will take your job: 98%

5. Financial Analyst

Financial analysts conduct broad research on industries, products, stocks, bonds and more to help companies make important financial/investment decisions. The best financial analysts are great researchers, analyzers, communicators and decisions makers, as they will likely be required to prepare reports, develop financial strategies and communicate those strategies to higher-ups in a company.

Median annual wage: $84,300

Common entry-level degree: Bachelor’s degree

Likelihood that robots will take your job: 23%

6. Budget Analyst

Budget analysts develop spending plans for various institutions, including businesses, schools, universities and the government. They conduct research and analyze past spendings, so they can effectively advise an institution on where its money is best spent. Sometimes, budget analysts are also tasked with keeping track of spending within a company to make sure it follows suit with the written budget plan. Good budget analysts have great research, analytical and communication skills, as they often have to pass their budget plan through their boss or a committee.

Median annual wage: $75,240

Common entry-level degree: Bachelor’s degree

Likelihood that robots will take your job: 94%

Less-Traditional Jobs For Finance Majors

7. Lawyer

Some finance majors go on to become lawyers. Generally, if you want to become a lawyer, you will also have to pass the Law School Admissions Test (LSAT), apply to law school, earn a Juris Doctor degree and pass the Bar examination — all before you can begin to practice law. Typically, it takes 3 years to graduate from law school, so the entire process takes 7-8 years. If you’re interested in earning your masters in finance while working towards your Juris Doctor degree, some universities, including the University of Arizona and Suffolk University, offer joint programs.

Median annual wage: $119,250

Common entry-level degree: Juris Doctor degree

Likelihood that robots will take your job: 4%

8. Professor

Patience, communication, organization and enthusiasm are some of the most important characteristics of a good college professor. To earn a job teaching at the post-secondary level, a master’s degree (and sometimes a doctorate degree) is required. In addition to teaching, some college professors also conduct research and write scholarly articles.

Median annual wage: $64,480

Common entry-level degree: Master’s degree

Likelihood that robots will take your job: 3%

9. Math Teacher

After earning a bachelor’s degree, those who aspire to teach in middle or high schools have to complete an internship in a school classroom, pass the state-required test for teachers and receive a teaching certificate/license.

If you are dead set on being a teacher, the best advice would be to major in education. But if you’re still uncertain about what you want to do, a business degree could ultimately help you land a job teaching math. As long as your degree is in a related field to the classes you aspire to teach, you will be okay.

Median annual wage: $57,350

Common entry-level degree: Bachelor’s degree & teaching certificate

Likelihood that robots will take your job: 0.8%

Other Potential Jobs For Finance Majors

10. Sales Representative

The analytical and communication skills taught through finance translate well to sales. Requirements vary from company to company, but good sales people should be able to speak comfortably with anyone at any time. Because sales jobs often involve cold calls, good sales people should also be able to quickly bounce back from rejection.

Median annual wage: $52,460 (varies heavily)

Common entry-level degree: High School diploma/Bachelor’s degree

Likelihood that robots will take your job: 85%

11. Personal Financial Advisor

Financial advisors most often develop plans and money management tactics to help individual people make smart decisions with the money they make. They evaluate a person’s income, savings and interests to try to help them get the most out of their money. Sometimes they work for big companies, and other times they can contract their services out privately. If a financial advisor is dealing with clients who possess large sums of money, he or she may be referred to as a wealth manager.

Median annual wage: $90,530

Common entry-level degree: Bachelor’s/Master’s degree

Likelihood that robots will take your job: 58%

12. Financial Services Sales Agents

Financial services sales agents buy, trade and sell commodities for individual clients. But if they’re working for an investment bank, they may advise clients to buy, sell and trade stocks and bonds, based on their analyses of market conditions. Financial services sales agents must have strong communication skills, be versed in math and be able to work in a fast-paced environment.

Median annual wage: $63,780

Common entry-level degree: Bachelor’s/Master’s degree

Likelihood that robots will take your job: 2%

10 Famous People Who Studied Finance

- Tempestt Bledsoe, actor

- Morris Chestnut, actor

- Kevin Costner, actor

- Phil Knight, business executive

- Kara Lawson, professional basketball player

- Vikram Pandit, business executive

- John Paulson, billionaire hedge fund manager

- Christine A. Poon, business executive

- Fredric G. Reynolds, business executive

- Jonathan Vilma, professional football player

To explore options for other majors, click here.