Best Accounting Jobs

While many people believe that an accounting degree offers a singular career path, this perception is far from accurate. The skills that accounting majors are taught in college — money management, communication, bookkeeping, statistics and math — prepare them for a variety of careers in business and government. Many accounting majors may pursue traditional careers in accounting and auditing, but there are plenty of alternative career paths for students and graduates willing to explore other options.

Here is a list of 12 jobs and career options for accounting majors:

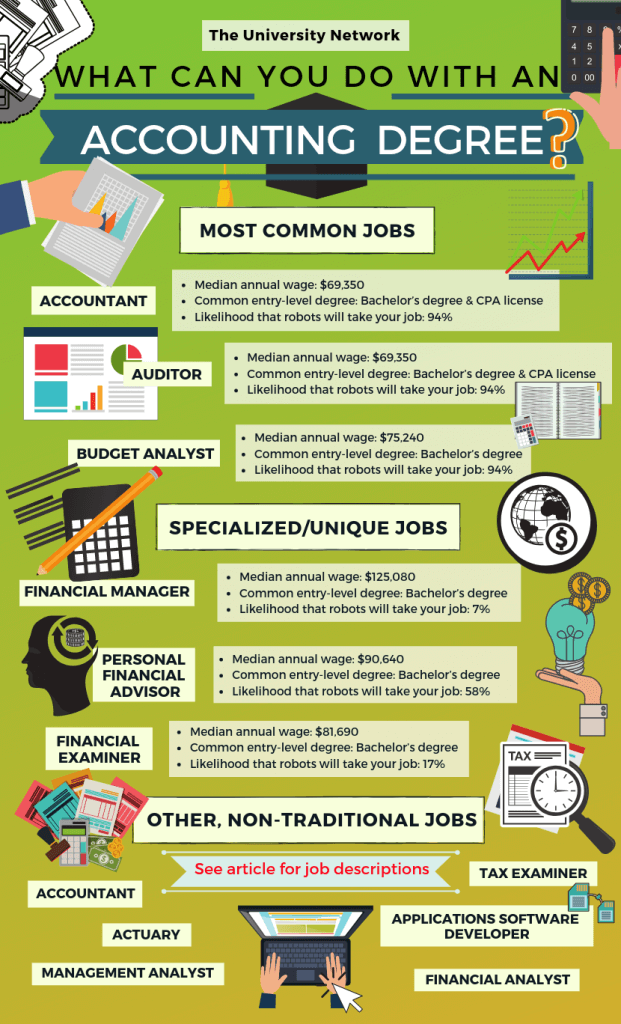

Most Common Jobs for Accounting Majors

1. Accountant

Accountants keep track of, analyze and archive an organization’s financial information. Depending on the size of the organization, accountants are also sometimes asked to give advice on how an organization should create their budget, spend, invest, and control its money. Nearly every organization needs accountants, including hospitals, nonprofits, insurance firms, and more. After completing a bachelor’s degree, those who aspire for a career as an accountant should become state-certified by passing the Certified Public Accountant (CPA) exam, which is administered by the American Institute of Certified Public Accountants.

Median annual wage: $69,350

Common entry-level degree: Bachelor’s degree & CPA license

Likelihood that robots will take your job: 94%

2. Auditor

Auditors analyze the financial accounts of organizations to ensure compliance with regulations and internal policies. In other words, they review the work of accountants, ensuring that no mistakes were made or regulations were violated in the accounting process. Large organizations may employ internal auditors who review books from within the organization and often formulate strategies for reducing waste and identifying fraud. Most auditors, however, are external auditors. External auditors are employed by accounting or auditing firms, and are brought in by client companies to review their financial records on occasion. Some organizations will perform periodical or yearly audits, while others may only hire an auditor in instances of suspected fraud or wrongdoing. A bachelor’s degree in accounting is typically required to pursue a career as an auditor.

Median annual wage: $69,350

Common entry-level degree: Bachelor’s degree & CPA license

Likelihood that robots will take your job: 94%

3. Budget Analyst

Budget analysts assist all types of organizations — businesses, governments, universities, etc. — on the management of their finances. They work alongside management to create budget reports and review budget proposals. They perform cost-benefit and other analyses of programs, and assess financial requests and funding methods. Based on their conclusions, they offer budget and funding recommendations to management, administrators, or legislators, but they generally do not make the final call on budgetary decisions. Additionally, they are responsible for ensuring that budgets have compliance with laws and regulations. A bachelor’s degree in accounting or a related subject is typically required for a career as a budget analyst.

Median annual wage: $75,240

Common entry-level degree: Bachelor’s degree

Likelihood that robots will take your job: 94%

Unique/Specialized Jobs for Accounting Majors

4. Financial Manager

Financial managers are responsible for overseeing an organization’s financial plan and ensuring its overall financial stability. They create and review financial reports, develop financial forecasts, and devise strategies to improve their employer’s financial health. They analyze markets and seek new opportunities for career growth through investments, mergers, acquisitions, or other means. They are also responsible for overseeing the organization’s financial reporting and budgeting staff. Becoming a financial manager requires a bachelor’s degree and at least five years of experience in a lower-level financial position, such as an accountant or financial analyst. Employers may seek out candidates with an advanced degree in a field related to finance.

Median annual wage: $125,080

Common entry-level degree: Bachelor’s degree

Likelihood that robots will take your job: 7%

5. Personal Financial Advisor

Personal financial advisors work with clients to discuss and meet their financial goals, providing advice on anything from investments to mortgages to retirement funds. A bachelor’s degree for a career in accounting is typically enough to gain entry into the field. Depending on your role in the company you work for, and particularly if you are involved in trading stocks and making investments, you may need licensing and certification from the Securities and Exchange Commission.

Median annual wage: $90,640

Common entry-level degree: Bachelor’s degree

Likelihood that robots will take your job: 58%

6. Financial Examiner

Financial examiners review the finances and transactions of financial organizations to ensure compliance with laws and evaluate the financial health of the organization. They are responsible for assessing the level of risk in loans and transactions and monitoring lending activity to protect borrowers and ensure that lenders do not offer predatory loans. Financial examiners may work within financial or insurance firms or in the state and federal government. Financial examiners have to stay up-to-date with new regulations and establish organizational policies to protect these regulations. A bachelor’s degree is needed for a career as a financial examiner.

Median annual wage: $81,690

Common entry-level degree: Bachelor’s degree

Likelihood that robots will take your job: 17%

Non-Traditional Jobs for Accounting Majors

7. Actuary

Actuaries use mathematics, statistics, and financial information and theory to assess the financial costs of risk and uncertainty. Actuaries work for a variety of businesses, and they are essential positions at financial consultancies, insurance agencies and banks. A bachelor’s degree in any field related to finance or business, including accounting, is typically all that’s needed to enter the industry. Aspiring actuaries must also pass a series of exams to become certified in the profession. Professional actuaries should be certified through the Casualty Actuarial Society (CAS) or the Society of Actuaries (SOA). Both groups have a unique set of tests you have to pass. If you recently graduated from college and want to have a career as an actuary, now is the time to start preparing for those tests. They can take hundreds of hours to prepare for.

Median annual wage: $101,560

Common entry-level degree: Bachelor’s degree

Likelihood that robots will take your job: 21%

8. Management Analyst

Management analysts, also known as management consultants, analyze an organization’s management structure and provide suggestions about how it can be improved to make the organization more profitable or efficient. Management analysts create in-depth research reports that take into account the information regarding an organization’s structure, the experiences and opinions of staff, and financial records. They then suggest changes to the organization’s structure or operation with the goal of improving the organization’s overall operation. While accounting majors do not typically pursue careers in management consulting, a degree in accounting provides a good foundation for a management consulting career. Management consultants frequently work alongside the accountants and financial managers, and must have a strong understanding of finance and business to succeed. Positions as management analysts are open to candidates with bachelor’s degrees, although most analysts have previous career experience in management positions. Some employers may seek out candidates with master’s degrees.

Median annual wage: $82,450

Common entry-level degree: Bachelor’s degree/Master’s degree

Likelihood that robots will take your job: 13%

9. Applications Software Developer

Accountants and other financial workers are increasingly reliant on computer software to assist them in organizing and analyzing financial data. Accountants with a knowledge of computer science and strong software development skills can pursue careers in developing software applications for use by accountants and other types of financial workers. A bachelor’s degree will typically qualify most candidates for entry-level software development positions. Accounting majors interested in working in a career in software development will need to take coursework and possibly pursue a minor or second major in computer science and become proficient in common programming languages.

Median annual wage: $101,790

Common entry-level degree: Bachelor’s degree

Likelihood that robots will take your job: 4%

Other Jobs for Accounting Majors

10. Tax Examiner

Tax examiners are employed by government tax authorities, such as the IRS, to review tax returns and conduct audits. In short, they are responsible for ensuring that individuals and businesses are paying their taxes properly. This involves confirming that taxpayers are reporting financial information accurately and that any deductions or tax credits claimed are done so within the parameters of the law. When tax examiners find that an individual or business has underpaid, they contact the taxpayer and issue penalties, interest, or fees. Likewise, if they find that a taxpayer has overpaid, they will issue refunds. A bachelor’s degree for a career in accounting or a related field is typically required to become a tax examiner.

Median annual wage: $53,130

Common entry-level degree: Bachelor’s degree

Likelihood that robots will take your job: 93%

11. Financial Analyst

Financial analysts are responsible for examining financial data in order to provide information and guidance to businesses or individuals on business and investment decisions. They are employed within the financial industry by investment banks and firms and outside of the financial industry by smaller banks, insurance companies, and real estate brokerages. Financial analysts will examine trends in the market and individual companies’ statements to compile investment recommendations. For a career as a financial analysts, typically you must have a bachelor’s degree in any field related to finance or business, including accounting.

Median annual wage: $84,300

Common entry-level degree: Bachelor’s degree

Likelihood that robots will take your job: 23%

12. College Professor

Accounting majors interested in the science and theory behind accounting may want to pursue a career in academia. Accounting professors give lectures to college students, teaching them the necessary skills to find success in the industry. Because an accounting degree is a professional degree, most accounting professors have previously worked a position as an accountant before transitioning into academia. In order to have a a career as a college professor, you will need at least a master’s degree and possibly a doctorate.

Median annual wage: $100,270

Common entry-level degree: Master’s degree/Ph.D.

Likelihood that robots will take your job: 3%

10 Famous People Who Studied Accounting

- Arthur Blank, businessman

- Cris Collinsworth, sports analyst & former football player

- Kenny G, musician

- John Grisham, novelist

- Gibby Haynes, musician

- Phil Knight, businessman

- Chuck Liddell, MMA fighter

- Bob Newhart, comedian

- Ray Romano, comedian and actor

- Julia Sweeney, comedian

To explore options for other majors, click here.