In the back of my mind I knew that if I wanted to move out of my father’s comfortable cardboard box apartment in Queens and stop living the life of a third wheel interrupting gooey romantic dinners between him and his girlfriend, I would have to get an apartment of my own. And to do that, even if I did have the money, there was something that I didn’t have – a line of credit.

I went to visit my mom in Chicago a few years back while I was a freshman in college and there we decided to apply for a credit card at Chase – they denied me – so I tried again. This time with Capital One – I was credit card approved. It was shipped in the mail – so shiny. I got a 300 dollar limit but it’s been sitting in my wallet since the end of August – clearly building the line of credit like I intended.

Forbes says “whether its effects are helpful or harmful depends on the skills and knowledge of the user…”

I had yet to activate my card because I didn’t understand the real purpose of the card and how I could use it to benefit me.

>>> So why is having a credit card important?

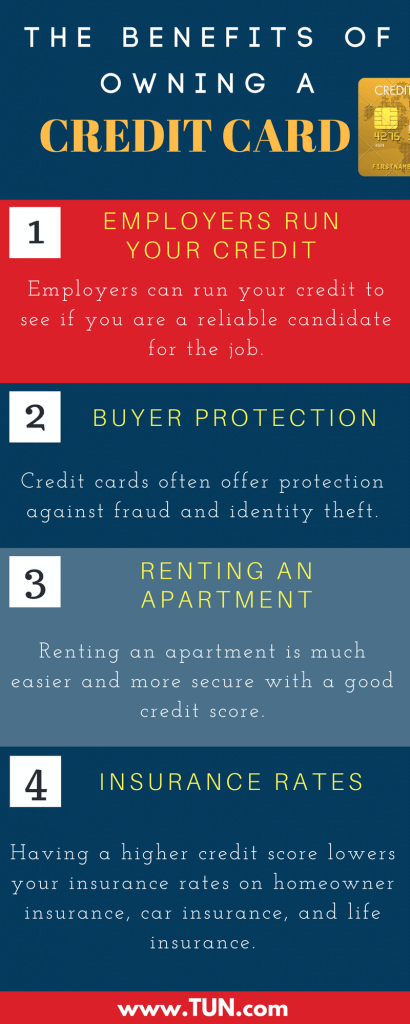

Thesimpledollar.com outlines 4 benefits of having a good credit score:

1. Employers run your credit.

Employers can run your credit score in order to distinguish if you are a reliable candidate for the job. As of now, if an employer tried to run my credit, virtually I would get up and see myself out.

2. Buyer Protection

If someone stole your identity and bought a thousand movies from a Red Box in North Carolina and complemented it with some M&Ms and popcorn, we might not be completely screwed. Credit offers great buyer protection. Cards often offer protection against fraud, identity theft and other heart stopping scenarios such as this one. Whereas if we pay in cash we might not be offered these protections.

3. Renting an apartment

If you’ve got a FICO score of 840 with no nasty bugger-sniffing children in sight, the apartment is yours. BINGO! If you want to rent an apartment, no credit will hike up your initial deposit and consequently with bad credit you’ve either gotta have a way with words or someone willing to co-sign (or superb reference letters from former landlords). Those with good credit take your apartment, wave goodbye and laugh at you from their window.

4. Insurance Rates

If I have a high credit score, this to insurance companies means statistically that I am more likely to be a safer driver, homeowner and more likely live until about 110 – rather than someone who has a lower credit score than I do. Fantastic! Having a higher credit score lowers my insurance rates on homeownership insurance, car insurance and life insurance.

When you feel the time is right, that you’ve got a solid grasp on what the card is used for and how to use it to your advantage…

>>> Get a credit card that’s right for you.

Not every credit card is the same. Some offer benefits, others offer rewards. Regardless, pay attention to the interest rates and annual fees and compare your options.

>>> Use it for small routine purchases.

Pay off your monthly grocery shopping or your monthly Netflix bill. It might sound logical but only use the card for purchases you can afford. Don’t carry a balance on the card.

>>> Pay on time and in full each month.

According to nerdwallet.com, “If you stick to just using the card for routine purchases, you should have no problem whatsoever paying off your entire bill each month. Thus, you never incur debt that generates interest.”

In order to actually build credit I might need to wipe the dust off my card and not only activate it, but use it. Use a credit card as a tool for leverage because it will just as easily dig you into a dark, never-ending hole of debt.